Business

When more of us pay with Interac Debit or Interac e-Transfer, more money stays with Canadian businesses.

Learn moreWhat's your interest?

More stories

Interac summer spending snapshot reveals how global pressures are reshaping Canadians’ purchase habits

Small spends, big impact: How Canadians are supporting local business this summer

How do you choose to pay? Learn what these small-business owners prefer

How Anita Grant is healing generations through natural hair

Explore topics

Powering the future of payroll: How Interac e-Transfer enables Earned Wage Access with ZayZoon and Scotiabank

Broadening Access to Interac e-Transfer® for Payment Service Providers: What you need to know

How Interac is leveraging AI to strengthen fraud detection

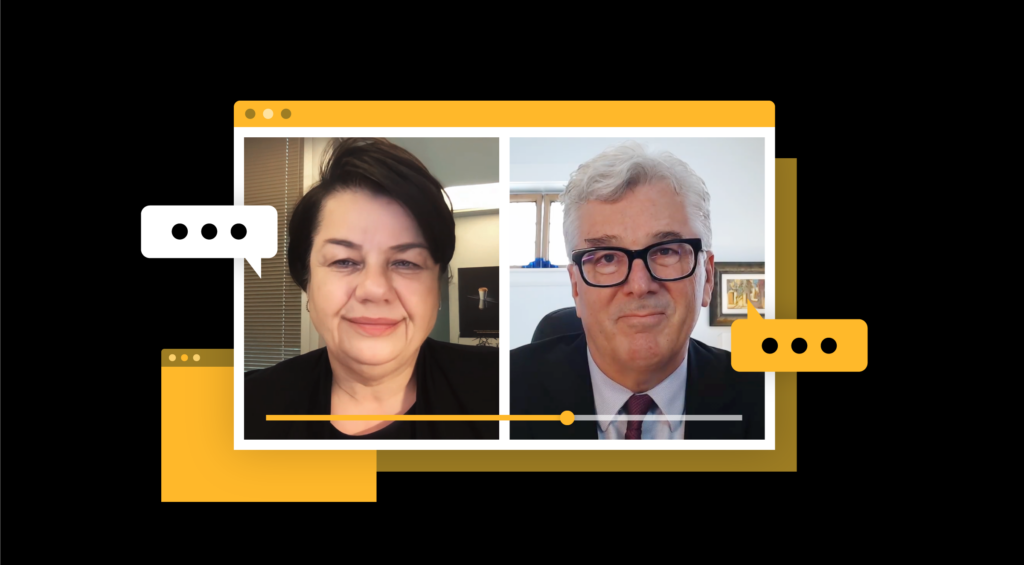

Putting privacy first: Interac in conversation with former Information and Privacy Commissioner of Ontario

From email fraud to phishing scams: How could fraudsters target your small business?

How Interac Debit helps your small business in the busiest times

Everyday Trust: Customers, data, and trust in financial services with Melanie Subin

How Vinny Welsby transforms Adversity into Advocacy

How Laura Whiteland is Transforming Canada’s Financial Landscape Through Inclusive Planning

How Ren Navarro is Transforming Conversations and Industries with B. Diversity.

How Queer Markets ignited success for this small business owner

Say yes to Interac e-Transfer during wedding season

Everyday Trust: Data, value creation, and the future of Canadian prosperity with Debbie Gamble and Amy Webb

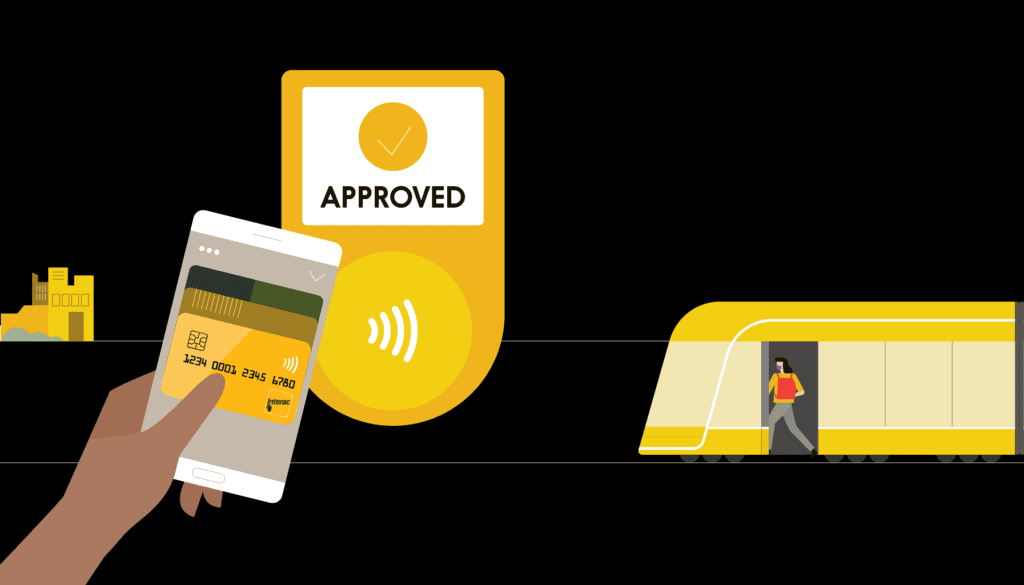

Modernizing how we pay for transit: Interac in conversation with Metrolinx

Faster, modern payments for a digital-first Canada: What’s the state of progress?

How small businesses can unlock their potential with Interac

Craft fairs and farmers’ markets: 4 steps to stellar service and sales success

How can innovators build trust in a digital, data-driven age?

From Dollar One: Chapter 2 — Mind Over Money

From Dollar One: Chapter 1 — Pay and Get Paid

From Dollar One

Everyday Trust: On Innovation and Economic Growth with Debbie Gamble and Jim Balsillie

AI: Clever programming or the next industrial revolution?

How Alicia Nicholson has disrupted the cosmetics industry by prioritizing transparency

Solutions for small businesses: What you need to know about what Interac e-Transfer can do for your business

For the greater good: Why this Canadian youth nonprofit switched to Interac e-Transfer for Business

Everyday Trust: On ‘Exponential’ Technology with Debbie Gamble and Anne Connelly

How Jacq Brasseur built a queer-centric business model for non-profits across Canada

The shift in commerce: Solving payment challenges for merchants

Bringing the right service to your storefront with Interac e-Transfer

Serve up faster payments with Interac e-Transfer

DeFi’s Tough 2022: What Went Wrong, Why, And Is There A Future?

Fuelling innovation in Canada

Distributed Autonomous Organizations (DAOs) & Society: A Fuzzy Future

Everyday Trust: The changing role of trust

Looking Ahead 2023: Innovating for the common good. Together.

How small business owners can stay in charge during crunch time

How Interac, Square and Calgary’s favourite sports franchises came together to support small businesses

How the new Interac Developer Portal is designed to fuel the innovation ecosystem

Bringing small business communities together, in Calgary and beyond

Time Is Money and You Should Save Both – The small biz owner’s guide to Interac e-Transfer for Business

What one billion Interac e-Transfer transactions mean for Canadian businesses

This Indigenous 2SLGBTQ+ CEO is hiring marginalized virtual assistants and growing her tech business

A Retailer’s Toolkit for the Big Shift

How this branding consultant helps marginalized entrepreneurs succeed

How this 2SLGBTQ+ company is creating safer travelling experiences for its community

Power of community: How this 2SLGBTQ+ vegan pasta company thrived during the pandemic

NFTs on the block

Faster digital payments can clear bottlenecks and create efficiency

‘Buy now, pay later’ gains ground in Canada: Five things to know

How the Abibiman Project leverages Interac e-Transfer to support local communities

The digital economy is evolving quickly: Payments Canada trends report

How the Interac e-Transfer platform is helping Lignum Honey soar

Resources for small business owners: Preparing for the growth of omnichannel payments

Be where the customer is: How these small businesses have thrived in the pandemic

Four payments shifts Canadian business owners need to know

How digital ID will make Canadians’ data more secure: Interac + SecureKey in conversation

Interac helps a Toronto brand pivot during the pandemic

Small business spotlight: Black Oak Boutique

Small business spotlight: Dancing Phil

The future of retail: Three solutions to support a digital local economy

Survey: Canadians want to spend locally after the pandemic. How can digital payments win their loyalty?

How Interac e-Transfer Request Money opened new doors for Brockton Haunt during the pandemic

Small Business Spotlight: Cup of Té

Interac welcomes inclusion of contactless payment options on UP Express

Our continued commitment to supporting small business

How FoodHero helps Canadians fight food waste — while shopping for groceries

Interac collaborates with Walmart Canada to expand debit payment options across digital shopping experience

6 Things leaders should do to avoid a data dystopia – In collaboration with Elevate

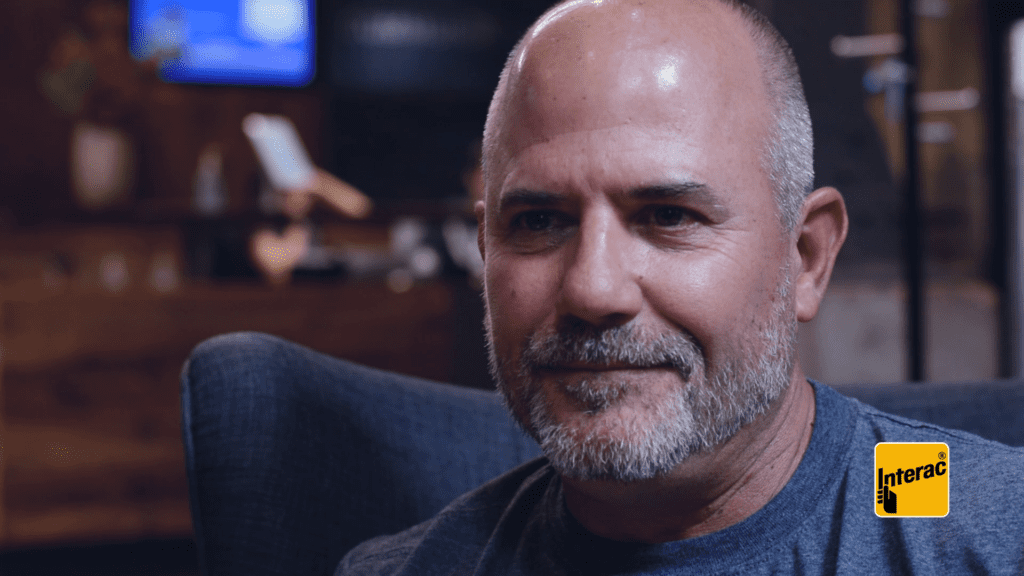

Simone shares the value of contactless and secure payments during COVID-19

Infographic: Five trends in Canadian consumer spending during COVID-19

Small Business Ideas: How Interac e-Transfer powers pandemic pivots

Confidence in cyber security will power growth in Canada’s digital economy

Why Dacyion Reid hasn’t let the pandemic scare her

Interac Debit data: Signs of COVID-19 recovery

From Gen Z to Baby Boomers: How different generations are using online money transfers during COVID-19

Kira Noel shares fast and easy solutions for running your own business

More Canadians are using digital wallets for take-out and delivery

From panic buying to curbside pickup: Canadian shopping trends during COVID-19

How COVID-19 is accelerating the shift to digital commerce and money transfers for Canadian consumers and businesses

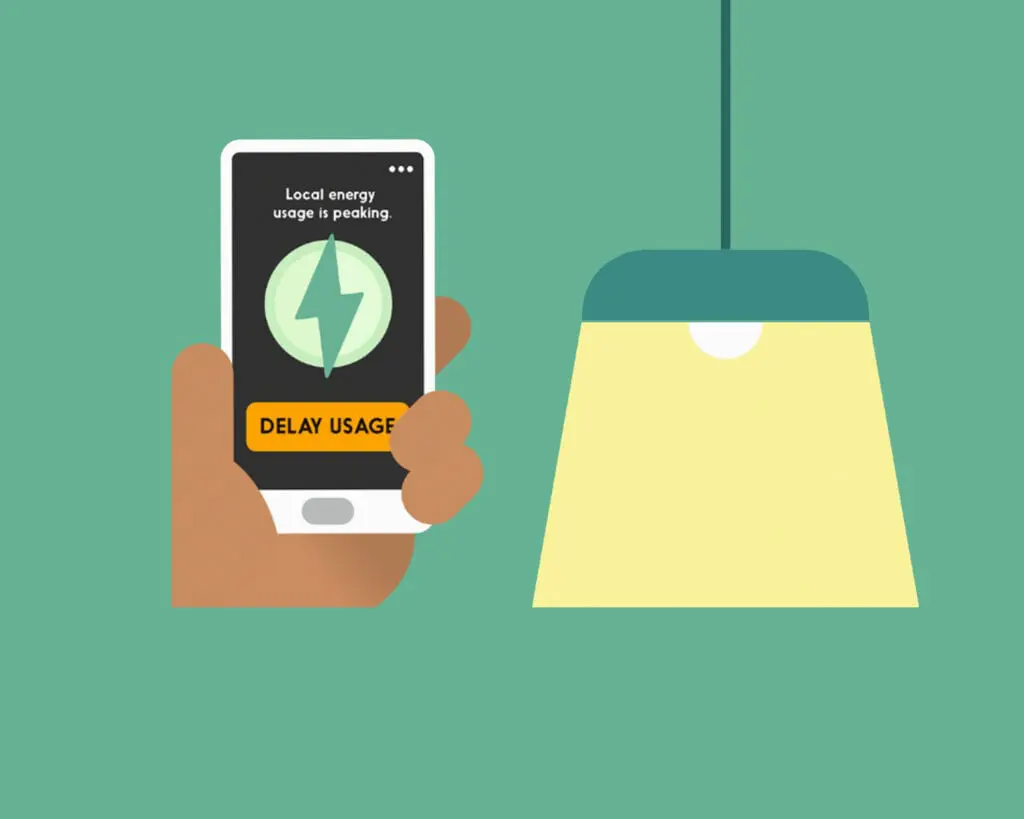

Powering better choices with real-time incentives

Digital fraud: A guide for Canadian businesses on keeping safe while working remotely

Streamlining your business with Arts Market

The debit advantage — lower fees, fewer hassles

The payment moment – lineups and the bottom line

What do customers want in a payment moment?

How Interac Debit contactless payments made this fast-food truck even faster

Unleashing the potential of this upscale pet boutique with Interac Debit contactless payments

How Interac Debit contactless payments helps this burger-flipping master keep on top of turnover

How Interac used its payment network to help power the future

This Small Business Month, celebrate business owners who build strong communities

How Interac Debit contactless payments unleashed the potential of one busy pet boutique

Why Canadian entrepreneurs choose Interac

Knowing your customers, faster with Edwina Johnson

Should your business adopt Interac Flash?

Canadian startups pitch digital ID innovations at Interac Collision Day

How to build a healthy business

How Interac e-Transfer helped one contractor make invoicing so much easier

How Interac e-Transfer helps one jeweller do what she loves

How a Toronto artist uses Interac e-Transfer to get paid easily

Three reasons millions of Canadians choose Interac e-Transfer every day

How freelancers can get paid easier and faster

How one Toronto real-estate pro found success on her own

One illustrator and small business owner’s secret to budgeting and getting paid using Interac e-Transfer

Canada’s entrepreneurs say not getting paid on time hinders growth

Why 2018 was another banner year for Interac e-Transfer

Interac by the numbers

Interac Flash just had another record-breaking year. Here are two reasons why.

The future of fintech with Oscar Roque and TWG

Top Tech Trends We’re Watching in 2019

Sweet deal: How Interac helps this sky-high urban beekeeping company keep its costs low

How going cashless has paid off big

Good ol’ fashioned customer service meets fast, efficient payments

Running a small business with Amy Harper Makeup

Five things you need to know about Interac Debit

Everyday Trust: Customers, data, and trust in financial services with Melanie Subin

Everyday Trust: Data, value creation, and the future of Canadian prosperity with Debbie Gamble and Amy Webb

Faster, modern payments for a digital-first Canada: What’s the state of progress?

How can innovators build trust in a digital, data-driven age?

Everyday Trust: On Innovation and Economic Growth with Debbie Gamble and Jim Balsillie

AI: Clever programming or the next industrial revolution?

Everyday Trust: On ‘Exponential’ Technology with Debbie Gamble and Anne Connelly

DeFi’s Tough 2022: What Went Wrong, Why, And Is There A Future?

Fuelling innovation in Canada

Distributed Autonomous Organizations (DAOs) & Society: A Fuzzy Future

Everyday Trust: The changing role of trust

Looking Ahead 2023: Innovating for the common good. Together.

How Interac, Square and Calgary’s favourite sports franchises came together to support small businesses

How the new Interac Developer Portal is designed to fuel the innovation ecosystem

A Retailer’s Toolkit for the Big Shift

NFTs on the block

‘Buy now, pay later’ gains ground in Canada: Five things to know

The digital economy is evolving quickly: Payments Canada trends report

Four payments shifts Canadian business owners need to know

The future of retail: Three solutions to support a digital local economy

Survey: Canadians want to spend locally after the pandemic. How can digital payments win their loyalty?

6 Things leaders should do to avoid a data dystopia – In collaboration with Elevate

Infographic: Five trends in Canadian consumer spending during COVID-19

Confidence in cyber security will power growth in Canada’s digital economy

Interac Debit data: Signs of COVID-19 recovery

From Gen Z to Baby Boomers: How different generations are using online money transfers during COVID-19

From panic buying to curbside pickup: Canadian shopping trends during COVID-19

Powering better choices with real-time incentives

Canadian startups pitch digital ID innovations at Interac Collision Day

Interac by the numbers

The future of fintech with Oscar Roque and TWG

Top Tech Trends We’re Watching in 2019

How Interac is leveraging AI to strengthen fraud detection

Putting privacy first: Interac in conversation with former Information and Privacy Commissioner of Ontario

From email fraud to phishing scams: How could fraudsters target your small business?

How digital ID will make Canadians’ data more secure: Interac + SecureKey in conversation

6 Things leaders should do to avoid a data dystopia – In collaboration with Elevate

Simone shares the value of contactless and secure payments during COVID-19

Confidence in cyber security will power growth in Canada’s digital economy

Digital fraud: A guide for Canadian businesses on keeping safe while working remotely

Knowing your customers, faster with Edwina Johnson

Powering the future of payroll: How Interac e-Transfer enables Earned Wage Access with ZayZoon and Scotiabank

Broadening Access to Interac e-Transfer® for Payment Service Providers: What you need to know

How Anita Grant is healing generations through natural hair

Say yes to Interac e-Transfer during wedding season

How small businesses can unlock their potential with Interac

Craft fairs and farmers’ markets: 4 steps to stellar service and sales success

Solutions for small businesses: What you need to know about what Interac e-Transfer can do for your business

For the greater good: Why this Canadian youth nonprofit switched to Interac e-Transfer for Business

How Jacq Brasseur built a queer-centric business model for non-profits across Canada

Bringing the right service to your storefront with Interac e-Transfer

Serve up faster payments with Interac e-Transfer

How small business owners can stay in charge during crunch time

Bringing small business communities together, in Calgary and beyond

Time Is Money and You Should Save Both – The small biz owner’s guide to Interac e-Transfer for Business

What one billion Interac e-Transfer transactions mean for Canadian businesses

This Indigenous 2SLGBTQ+ CEO is hiring marginalized virtual assistants and growing her tech business

A Retailer’s Toolkit for the Big Shift

How this branding consultant helps marginalized entrepreneurs succeed

How this 2SLGBTQ+ company is creating safer travelling experiences for its community

Power of community: How this 2SLGBTQ+ vegan pasta company thrived during the pandemic

Faster digital payments can clear bottlenecks and create efficiency

How the Abibiman Project leverages Interac e-Transfer to support local communities

How the Interac e-Transfer platform is helping Lignum Honey soar

Resources for small business owners: Preparing for the growth of omnichannel payments

Be where the customer is: How these small businesses have thrived in the pandemic

Four payments shifts Canadian business owners need to know

Interac helps a Toronto brand pivot during the pandemic

How Interac e-Transfer Request Money opened new doors for Brockton Haunt during the pandemic

Small Business Spotlight: Cup of Té

Our continued commitment to supporting small business

Simone shares the value of contactless and secure payments during COVID-19

Infographic: Five trends in Canadian consumer spending during COVID-19

Small Business Ideas: How Interac e-Transfer powers pandemic pivots

Why Dacyion Reid hasn’t let the pandemic scare her

From Gen Z to Baby Boomers: How different generations are using online money transfers during COVID-19

Kira Noel shares fast and easy solutions for running your own business

How COVID-19 is accelerating the shift to digital commerce and money transfers for Canadian consumers and businesses

Powering better choices with real-time incentives

Streamlining your business with Arts Market

How Interac used its payment network to help power the future

This Small Business Month, celebrate business owners who build strong communities

How to build a healthy business

How Interac e-Transfer helped one contractor make invoicing so much easier

How Interac e-Transfer helps one jeweller do what she loves

How a Toronto artist uses Interac e-Transfer to get paid easily

Three reasons millions of Canadians choose Interac e-Transfer every day

How freelancers can get paid easier and faster

How one Toronto real-estate pro found success on her own

One illustrator and small business owner’s secret to budgeting and getting paid using Interac e-Transfer

Canada’s entrepreneurs say not getting paid on time hinders growth

Why 2018 was another banner year for Interac e-Transfer

Interac by the numbers

Running a small business with Amy Harper Makeup

Putting privacy first: Interac in conversation with former Information and Privacy Commissioner of Ontario

Everyday Trust: Customers, data, and trust in financial services with Melanie Subin

Everyday Trust: Data, value creation, and the future of Canadian prosperity with Debbie Gamble and Amy Webb

How small businesses can unlock their potential with Interac

How can innovators build trust in a digital, data-driven age?

Everyday Trust: On Innovation and Economic Growth with Debbie Gamble and Jim Balsillie

Everyday Trust: On ‘Exponential’ Technology with Debbie Gamble and Anne Connelly

Everyday Trust: The changing role of trust

How digital ID will make Canadians’ data more secure: Interac + SecureKey in conversation

Canadian startups pitch digital ID innovations at Interac Collision Day

Interac by the numbers

Top Tech Trends We’re Watching in 2019

Get tips for your small business, whether you're starting out, scaling up or just continuing your growth.

ECRM Landing Page Form

"*" indicates required fields

Explore topics

Powering the future of payroll: How Interac e-Transfer enables Earned Wage Access with ZayZoon and Scotiabank

Broadening Access to Interac e-Transfer® for Payment Service Providers: What you need to know

How Interac is leveraging AI to strengthen fraud detection

Great Canadian Entertainment transforms loyalty onboarding with Interac document verification service

How Certn is turning drop-offs into conversions with Interac Verified

A letter from the CEO: Connecting Canada to the possibilities of the digital economy

A letter from the Chair of the Board: Setting the stage for the next three years

2024 Interac Government Relations & External Affairs (GR&EA) Summary

A Turning Point For Canada’s Economic Sovereignty

Putting privacy first: Interac in conversation with former Information and Privacy Commissioner of Ontario

Interac at 40: Looking forward to a faster and more secure digital future for Canada

Leading Canadians to digital prosperity by verification services, faster digital products, and enhanced fraud prevention

Stewards of trust: How individuals and institutions shape confidence in our modern world

Everyday Trust: Customers, data, and trust in financial services with Melanie Subin

How Interac will lead Canada to digital prosperity

Everyday Trust: Data, value creation, and the future of Canadian prosperity with Debbie Gamble and Amy Webb

How Interac e-Transfer can open the door to efficiency and cost savings for landlords

Modernizing how we pay for transit: Interac in conversation with Metrolinx

Faster, modern payments for a digital-first Canada: What’s the state of progress?

Broadening our government relations

A letter from the Chair of the Board: Supporting Interac in its next chapter

A letter from the CEO: Leading with vision in the next era of the digital economy

Unlocking the Potential of Digital Verification in Insurance

Productivity and prosperity: Technology’s role in shaping Canada’s future

Looking ahead: Catalyzing productivity growth in Canada through digital innovation

How digital verification solutions can unlock new opportunities for Canadian businesses

Interac Verified: What is it, and what can it do for your business?

How Interac is bringing innovation to another critical frontier: digital verification

We Geek Out On Payments: A case for modernizing financial transactions in property management

How can innovators build trust in a digital, data-driven age?

Why consumer consent will be pivotal for open banking in Canada

Everyday Trust: On Innovation and Economic Growth with Debbie Gamble and Jim Balsillie

Increasing convenience for Canadians by prioritizing digital payments and verification services

AI: Clever programming or the next industrial revolution?

We Geek Out on Digital Verification: Insights from Canadian Business Decision Makers

Everyday Trust: On Digital Competitiveness with Debbie Gamble and Senator Colin Deacon

How you and your customers will take charge with Interac – wherever they are

Everyday Trust: On ‘Exponential’ Technology with Debbie Gamble and Anne Connelly

How Interac keeps pace with regulation and innovation, in Canada and beyond

Payments modernization: Empowering consumers and businesses to do more

The Digital Authentication and Verification Timeline

DeFi’s Tough 2022: What Went Wrong, Why, And Is There A Future?

Everyday Trust: On Digital Health with Debbie Gamble and Zayna Khayat

Fuelling innovation in Canada

A letter from the CEO: Connecting Canadians to the digital economy

A letter from the Chair of the Board: Connecting Canadians to the digital economy

Distributed Autonomous Organizations (DAOs) & Society: A Fuzzy Future

Everyday Trust: The changing role of trust

Everyday Trust: On Identity with Debbie Gamble and David Birch

Looking Ahead 2023: Innovating for the common good. Together.

How the new Interac Developer Portal is designed to fuel the innovation ecosystem

Interac provides Canadians with secure access to government services, closing in on 100 million transactions for the year

Prioritizing digital innovation through collaboration in Canada

Interac and Flybits in conversation: Why engaging customers requires a new digital approach

Business payments: Why Interac is investing in finance transformation inside our own walls

NFTs on the block

Open banking in Canada. What will success look like?

What digital verification means for Canadians

‘Buy now, pay later’ gains ground in Canada: Five things to know

Interac President and CEO Mark O’Connell identifies shared vision for Canada’s digital payments and identification landscape in speech at Empire Club of Canada

Navigating the ‘Big Shift’ in Canadian consumer payment choices

The path forward for digital ID in Canada

Central banks shake up the future of money with digital currencies

FEI x Interac: The moment has arrived for finance transformation

Looking Ahead to 2022: How Canada Can Take on Another Year of Disruption

The digital economy is evolving quickly: Payments Canada trends report

How digital ID has the potential to enhance convenience and security in healthcare, real estate, air travel — and more

Digital Identity in Employment

How digital ID will make Canadians’ data more secure: Interac + SecureKey in conversation

Realizing the Potential of Digital Verification in Real Estate

COVID-19: Accelerating digital trends in Canada

Interac in conversation: Helping stressed-out Canadians with fraud prevention

Charity payment processing + Interac e-Transfer: How Interac teed up quick-reference code donations for Ronald McDonald House Toronto

Digital Identity in Municipal Services

Faster Payments ‘a Global Trend’: Interac and Payments Canada on the opportunities of the Real-Time Rail (RTR)

Honk launches Interac Debit® payments online and in-app for parking

Interac and Shopify in conversation: Why ‘omnichannel’ is essential for retail

Interac welcomes inclusion of contactless payment options on UP Express

The possibilities and questions for a Canadian-made open banking framework

Business, innovation, and digital disruption: What to expect in 2021

The moment has arrived for faster business payments in Canada

Moving open banking forward through collaboration

Digital Identity in Air Travel

Interac collaborates with Walmart Canada to expand debit payment options across digital shopping experience

Digital Identity in Healthcare

6 Things leaders should do to avoid a data dystopia – In collaboration with Elevate

Infographic: Five trends in Canadian consumer spending during COVID-19

Core principles for building digital identity in Canada

Confidence in cyber security will power growth in Canada’s digital economy

Interac met with D&I leaders to discuss best practices for creating a more diverse and inclusive workplace

Digital Identity in Lottery & Gaming

How contactless payments can help transit systems recover from COVID-19

Interac Debit data: Signs of COVID-19 recovery

COVID-19: Economic impact and recovery in Canada

How will Canada’s public transit systems adapt after the pandemic?

Open-loop payment systems for transit: A tale of three cities

Digital Identity in Alcohol & Cannabis

From Gen Z to Baby Boomers: How different generations are using online money transfers during COVID-19

From panic buying to curbside pickup: Canadian shopping trends during COVID-19

Powering better choices with real-time incentives

How Governments Can Use Interac e-Transfer to Provide Canadians with Payments Quickly and Securely

Building a Strong and Resilient Remote Work Culture during COVID-19

Work-From-Home Wellness: Empowering staff to prioritize mental health while working from home

What Interac is doing to prevent digital fraud in Canada

A new horizon for Digital ID

The 2020s: Paths taken and paths ahead

How trust and collaboration will deliver the future

How Interac used its payment network to help power the future

Interac Debit for In-App and In-Browser Payments Expands in Canada

Interac and Elevate 2019: Six things we learned

How Interac engages with the tech community (at Elevate and beyond)

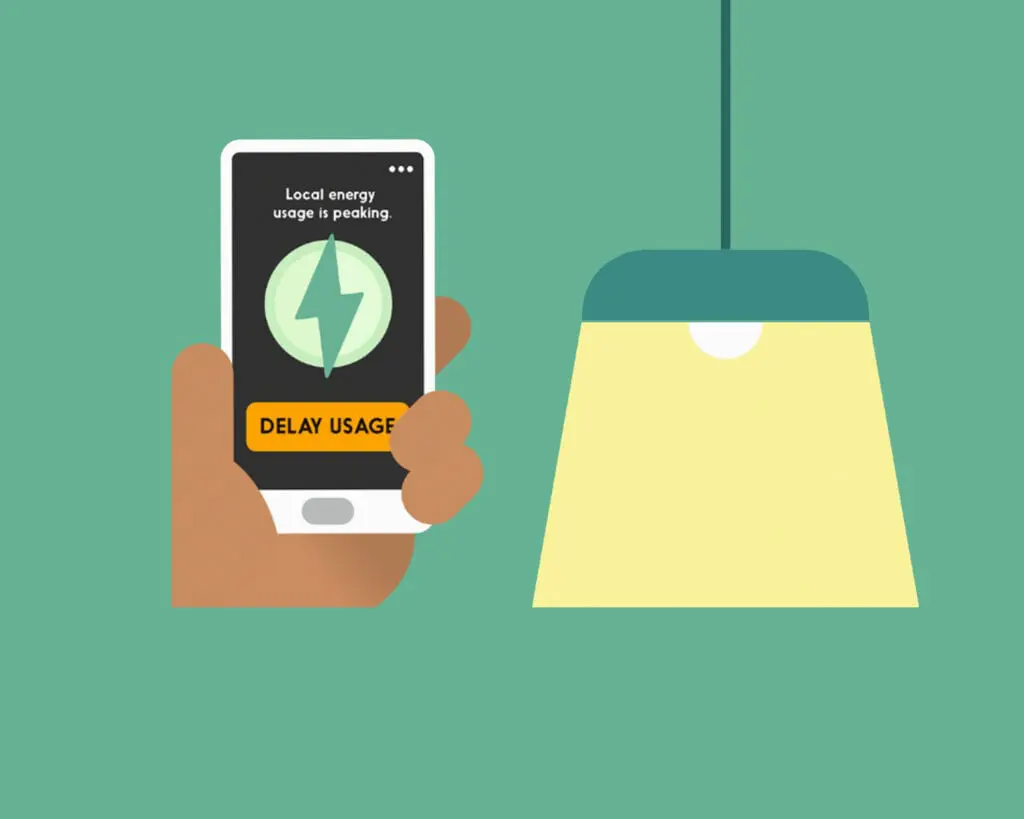

How Interac used blockchain technology to create energy incentives, instantly

Digital ID: Three big opportunities – and three challenges

Handling privacy and data issues in Canada’s new Digital Charter

Canadian startups pitch digital ID innovations at Interac Collision Day

What is the future of open banking?

Three reasons millions of Canadians choose Interac e-Transfer every day

Innovating at Interac: five tips growing companies should use for an engaged culture

Why 2018 was another banner year for Interac e-Transfer

Interac by the numbers

Interac Flash just had another record-breaking year. Here are two reasons why.

The future of fintech with Oscar Roque and TWG

Digital Identity in Drivers Licencing

Digital Identity in Immigration

Top Tech Trends We’re Watching in 2019

Blockchain: Why good governance matters

Digital Identity in Health

Calgary’s Fintech moment is here, and it’s just getting started

Why Privacy by Design is essential for Canada’s digital future

Agentic Commerce is Coming. Is Canada Ready?

A letter from the CEO: Connecting Canada to the possibilities of the digital economy

A Turning Point For Canada’s Economic Sovereignty

Interac at 40: Looking forward to a faster and more secure digital future for Canada

Leading Canadians to digital prosperity by verification services, faster digital products, and enhanced fraud prevention

Stewards of trust: How individuals and institutions shape confidence in our modern world

Everyday Trust: Customers, data, and trust in financial services with Melanie Subin

How Interac will lead Canada to digital prosperity

Everyday Trust: Data, value creation, and the future of Canadian prosperity with Debbie Gamble and Amy Webb

Faster, modern payments for a digital-first Canada: What’s the state of progress?

A letter from the CEO: Leading with vision in the next era of the digital economy

Productivity and prosperity: Technology’s role in shaping Canada’s future

Looking ahead: Catalyzing productivity growth in Canada through digital innovation

How Interac is bringing innovation to another critical frontier: digital verification

How can innovators build trust in a digital, data-driven age?

Why consumer consent will be pivotal for open banking in Canada

Everyday Trust: On Innovation and Economic Growth with Debbie Gamble and Jim Balsillie

AI: Clever programming or the next industrial revolution?

Everyday Trust: On Digital Competitiveness with Debbie Gamble and Senator Colin Deacon

Everyday Trust: On ‘Exponential’ Technology with Debbie Gamble and Anne Connelly

How Interac keeps pace with regulation and innovation, in Canada and beyond

Payments modernization: Empowering consumers and businesses to do more

DeFi’s Tough 2022: What Went Wrong, Why, And Is There A Future?

Everyday Trust: On Digital Health with Debbie Gamble and Zayna Khayat

A letter from the Chair of the Board: Connecting Canadians to the digital economy

A letter from the CEO: Connecting Canadians to the digital economy

Fuelling innovation in Canada

Distributed Autonomous Organizations (DAOs) & Society: A Fuzzy Future

Everyday Trust: The changing role of trust

Looking Ahead 2023: Innovating for the common good. Together.

How the new Interac Developer Portal is designed to fuel the innovation ecosystem

Prioritizing digital innovation through collaboration in Canada

Interac and Flybits in conversation: Why engaging customers requires a new digital approach

NFTs on the block

Open banking in Canada. What will success look like?

‘Buy now, pay later’ gains ground in Canada: Five things to know

Navigating the ‘Big Shift’ in Canadian consumer payment choices

Central banks shake up the future of money with digital currencies

FEI x Interac: The moment has arrived for finance transformation

Looking Ahead to 2022: How Canada Can Take on Another Year of Disruption

The digital economy is evolving quickly: Payments Canada trends report

COVID-19: Accelerating digital trends in Canada

Interac in conversation: Helping stressed-out Canadians with fraud prevention

Faster Payments ‘a Global Trend’: Interac and Payments Canada on the opportunities of the Real-Time Rail (RTR)

The possibilities and questions for a Canadian-made open banking framework

Business, innovation, and digital disruption: What to expect in 2021

Moving open banking forward through collaboration

6 Things leaders should do to avoid a data dystopia – In collaboration with Elevate

Infographic: Five trends in Canadian consumer spending during COVID-19

Confidence in cyber security will power growth in Canada’s digital economy

How contactless payments can help transit systems recover from COVID-19

Interac Debit data: Signs of COVID-19 recovery

COVID-19: Economic impact and recovery in Canada

How will Canada’s public transit systems adapt after the pandemic?

From Gen Z to Baby Boomers: How different generations are using online money transfers during COVID-19

From panic buying to curbside pickup: Canadian shopping trends during COVID-19

Powering better choices with real-time incentives

The 2020s: Paths taken and paths ahead

How trust and collaboration will deliver the future

Interac and Elevate 2019: Six things we learned

How Interac engages with the tech community (at Elevate and beyond)

Digital ID: Three big opportunities – and three challenges

Canadian startups pitch digital ID innovations at Interac Collision Day

What is the future of open banking?

Interac by the numbers

The future of fintech with Oscar Roque and TWG

Top Tech Trends We’re Watching in 2019

Blockchain: Why good governance matters

Why Privacy by Design is essential for Canada’s digital future

How Interac is leveraging AI to strengthen fraud detection

Putting privacy first: Interac in conversation with former Information and Privacy Commissioner of Ontario

Leading Canadians to digital prosperity by verification services, faster digital products, and enhanced fraud prevention

How digital ID will make Canadians’ data more secure: Interac + SecureKey in conversation

Interac in conversation: Helping stressed-out Canadians with fraud prevention

6 Things leaders should do to avoid a data dystopia – In collaboration with Elevate

Confidence in cyber security will power growth in Canada’s digital economy

What Interac is doing to prevent digital fraud in Canada

Powering the future of payroll: How Interac e-Transfer enables Earned Wage Access with ZayZoon and Scotiabank

Broadening Access to Interac e-Transfer® for Payment Service Providers: What you need to know

Interac at 40: Looking forward to a faster and more secure digital future for Canada

How Interac e-Transfer can open the door to efficiency and cost savings for landlords

Broadening our government relations

A letter from the Chair of the Board: Supporting Interac in its next chapter

We Geek Out On Payments: A case for modernizing financial transactions in property management

Payments modernization: Empowering consumers and businesses to do more

Prioritizing digital innovation through collaboration in Canada

Interac and Flybits in conversation: Why engaging customers requires a new digital approach

Business payments: Why Interac is investing in finance transformation inside our own walls

Interac President and CEO Mark O’Connell identifies shared vision for Canada’s digital payments and identification landscape in speech at Empire Club of Canada

Navigating the ‘Big Shift’ in Canadian consumer payment choices

Charity payment processing + Interac e-Transfer: How Interac teed up quick-reference code donations for Ronald McDonald House Toronto

Faster Payments ‘a Global Trend’: Interac and Payments Canada on the opportunities of the Real-Time Rail (RTR)

The moment has arrived for faster business payments in Canada

Infographic: Five trends in Canadian consumer spending during COVID-19

COVID-19: Economic impact and recovery in Canada

From Gen Z to Baby Boomers: How different generations are using online money transfers during COVID-19

Powering better choices with real-time incentives

How Governments Can Use Interac e-Transfer to Provide Canadians with Payments Quickly and Securely

How trust and collaboration will deliver the future

How Interac used its payment network to help power the future

How Interac used blockchain technology to create energy incentives, instantly

Three reasons millions of Canadians choose Interac e-Transfer every day

Why 2018 was another banner year for Interac e-Transfer

Interac by the numbers

The future of payments is already here—and it starts with verification.

Great Canadian Entertainment transforms loyalty onboarding with Interac document verification service

How Certn is turning drop-offs into conversions with Interac Verified

Putting privacy first: Interac in conversation with former Information and Privacy Commissioner of Ontario

Interac at 40: Looking forward to a faster and more secure digital future for Canada

Leading Canadians to digital prosperity by verification services, faster digital products, and enhanced fraud prevention

Stewards of trust: How individuals and institutions shape confidence in our modern world

Everyday Trust: Customers, data, and trust in financial services with Melanie Subin

Everyday Trust: Data, value creation, and the future of Canadian prosperity with Debbie Gamble and Amy Webb

Broadening our government relations

A letter from the Chair of the Board: Supporting Interac in its next chapter

Unlocking the Potential of Digital Verification in Insurance

How digital verification solutions can unlock new opportunities for Canadian businesses

Interac Verified: What is it, and what can it do for your business?

How Interac is bringing innovation to another critical frontier: digital verification

How can innovators build trust in a digital, data-driven age?

Everyday Trust: On Innovation and Economic Growth with Debbie Gamble and Jim Balsillie

Increasing convenience for Canadians by prioritizing digital payments and verification services

We Geek Out on Digital Verification: Insights from Canadian Business Decision Makers

Everyday Trust: On Digital Competitiveness with Debbie Gamble and Senator Colin Deacon

How you and your customers will take charge with Interac – wherever they are

Everyday Trust: On ‘Exponential’ Technology with Debbie Gamble and Anne Connelly

The Digital Authentication and Verification Timeline

Everyday Trust: On Digital Health with Debbie Gamble and Zayna Khayat

Everyday Trust: The changing role of trust

Everyday Trust: On Identity with Debbie Gamble and David Birch

Interac provides Canadians with secure access to government services, closing in on 100 million transactions for the year

Prioritizing digital innovation through collaboration in Canada

What digital verification means for Canadians

Interac President and CEO Mark O’Connell identifies shared vision for Canada’s digital payments and identification landscape in speech at Empire Club of Canada

The path forward for digital ID in Canada

How digital ID has the potential to enhance convenience and security in healthcare, real estate, air travel — and more

Digital Identity in Employment

How digital ID will make Canadians’ data more secure: Interac + SecureKey in conversation

Realizing the Potential of Digital Verification in Real Estate

COVID-19: Accelerating digital trends in Canada

Digital Identity in Municipal Services

Business, innovation, and digital disruption: What to expect in 2021

Digital Identity in Air Travel

Digital Identity in Healthcare

Core principles for building digital identity in Canada

Digital Identity in Lottery & Gaming

Digital Identity in Alcohol & Cannabis

A new horizon for Digital ID

How trust and collaboration will deliver the future

Interac and Elevate 2019: Six things we learned

How Interac engages with the tech community (at Elevate and beyond)

Digital ID: Three big opportunities – and three challenges

Handling privacy and data issues in Canada’s new Digital Charter

Canadian startups pitch digital ID innovations at Interac Collision Day

Interac by the numbers

Digital Identity in Drivers Licencing

Digital Identity in Immigration

Top Tech Trends We’re Watching in 2019

Digital Identity in Health

Stay on top of the future of payments, digital verification, and other technologies that can help your organization grow.

ECRM Landing Page Form

"*" indicates required fields