Did you know companies with fewer than 99 employees make up 98 per cent of all Canadian businesses? Not only that, small businesses in the private sector generate more than 37 per cent of the country’s GDP.

Small and micro businesses are a powerful force fuelling the Canadian economy. Interac is proud to support them, in part by offering services that allow small enterprises to solve business problems, unlock their full potential, and compete on the same playing field as their larger competitors.

To help Canadian SMBs achieve these things, we’ve put together a free e-book explaining some ways you can thrive and grow by taking advantage of the power of Interac Debit, Interac e-Transfer and Interac e-Transfer for Business. There’s a link to download it at the bottom of this article.

In the meantime, here’s a preview of what you’ll learn — with insights from real business owners from across Canada:

- Use Interac e-Transfer to pay vendors, contractors and employees

- Use Interac e-Transfer to request payment

- Use Interac e-Transfer for Business to make payments in real time (and on time)

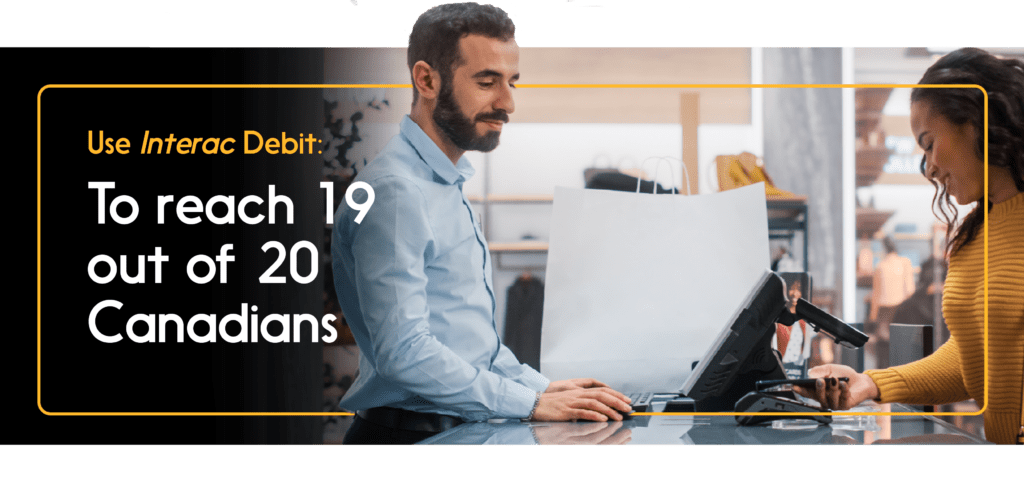

- Use Interac Debit to reach 19 out of 20 Canadians

- Use Interac Debit for your business to stay competitive

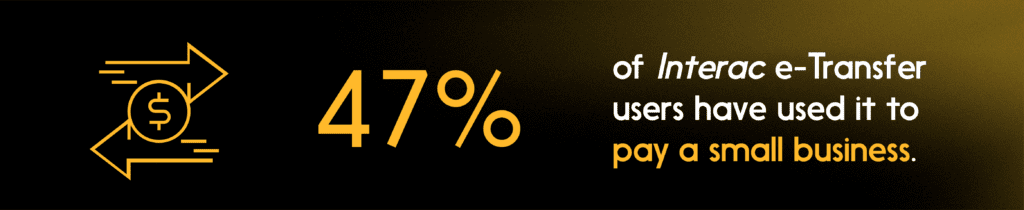

You may be familiar with Interac e-Transfer as a money transfer solution that millions of Canadians use and trust every day. But did you know it can also be a business tool, giving you payment flexibility in a competitive environment? For example, you can use it to securely pay employees, contract workers, suppliers and vendors, while spending less time on administration. No cash, no cheques, less paperwork – it’s secure, fast, and easy.

Early on, we used INTERAC for everything. That’s how we paid for supply orders and it’s how we paid for payroll.

Read her story: Alicia Nicholson (she/her), Founder of Upfront Cosmetics

How you can use Interac e-Transfer

- Send money to vendors and make payments for regular expenses, such as rent or utilities.

- Request money from customers to reconcile billing.

- Set up Interac e-Transfer Autodeposit to receive funds directly into your account without the need for a security question and answer.

Learn how to use Interac e-Transfer to make business payments.

Traditional invoices and cheques just don’t offer the speed that businesses need in a digital age. Use Interac e-Transfer Request Money to take the paper out of invoicing and get paid faster — and imagine how much better your cash flow could be. The digital format makes it easier to reconcile billing, too.

My business wouldn’t have been able to survive if I didn’t have [INTERAC e-Transfer as a] payment option.

Read her story: Kelsey Deer, KEL Tech Gear

See how easy it is to request payment using Interac e-Transfer Request Money.

Level up to Interac e-Transfer for Business when your business needs to take advantage of features like higher transaction limits and rich data. And real-time payment processing, too: Interac e-Transfer for Business processes transactions in real time. (More than 84% of transactions are deposited within seconds.) That allows you to minimize late payments and follow-ups from suppliers.

What I really like about INTERAC e-Transfer is that I can send the money when I need to send it and know that it is coming out of my account at that moment in time.

Read her story: Kailey Gilchrist, NONA Vegan

How you can use Interac e-Transfer for Business

- Securely pay employees or contract workers while spending less time on administration.

- Pay bills, such as rent or utilities, more efficiently.

- Collect client deposits or reconcile client billing with immediate access to incoming funds.

- Process transactions in real time to minimize late payments and follow-ups from suppliers.

Stop waiting for cheques. Learn how to move faster with Interac e-Transfer for Business.

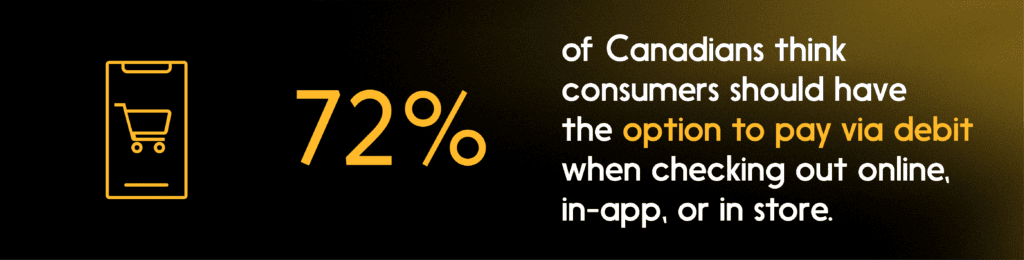

Did you know 95 per cent of Canadians have a debit card? By offering Interac Debit, you’re taking advantage of a payment method that the vast majority of people have access to. And when you give your customers the choice to check out how they want with Interac Debit, you’ll have the confidence of knowing that they’re using a secure payment solution you can trust.

Being able to purchase something with INTERAC Debit and buy online has helped a lot of my customers find my work and purchase from me.

Read her story: Heather Hansler, Little Rainbow Paper Co.

Learn more about the benefits of offering Interac Debit.

With Interac Debit in your payment toolbox, you can rest easy knowing you’re offering a secure and convenient payment method – while paying a low and flat transaction fee, as well as staying clear of chargebacks. Other benefits include low-friction checkout and easy refunds. And maybe best of all: You receive payments quickly.

Shifting to a more direct-to-consumer model meant we were just collecting way more payments through INTERAC Debit contactless payments. If it wasn’t for Interac, I don’t know how we would’ve gotten through that period.

Read his story: Matteo Sgaramella, Outclass

The benefits of accepting Interac Debit

- Immediate funds

- Economical pricing

- Trusted brand

- Secure

- Access to all Canadian debit card holders

Find an Acquirer that offers Interac Debit for point-of-sale services.

Learn more about what Interac can do for your business.