Interac e-Transfer has become an integral part of Canadians’ daily lives. Year after year, the service has seen consistent growth, and 2018 was no exception. As a few key statistics show, it’s easy to understand why last year was one of the most notable in the product’s history.

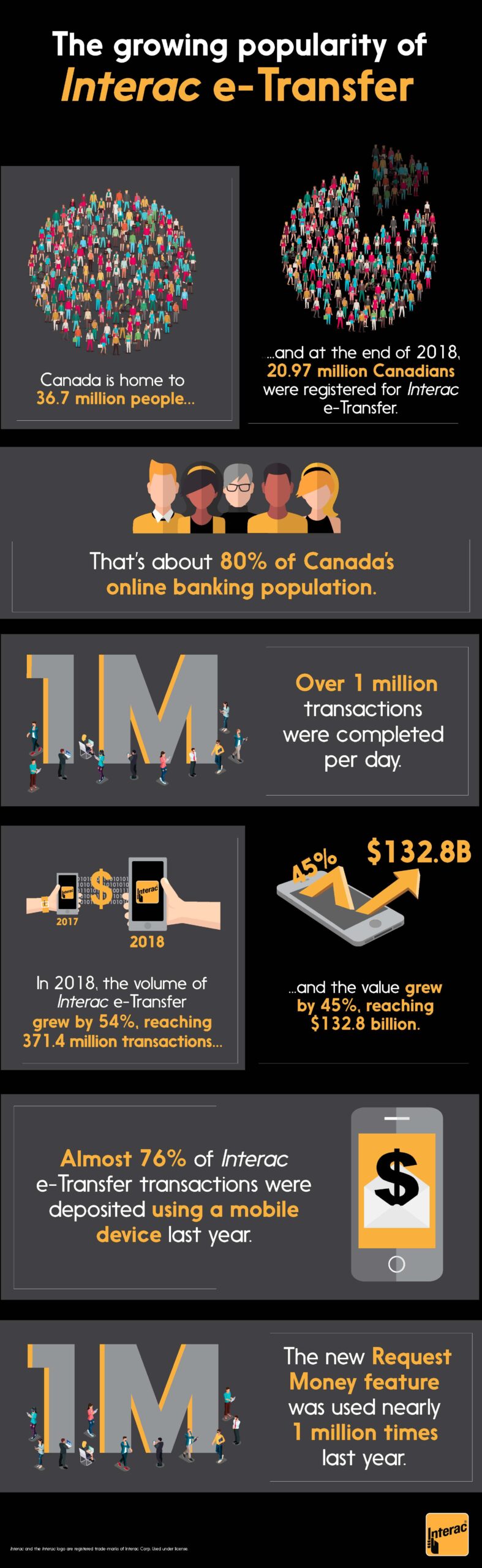

With a majority of Canadians using Interac e-Transfer to send, receive, and request money, the service has become more popular than ever before. By the end of 2018, 20.97 million users had registered for Interac e-Transfer, representing about 57 per cent of the country’s total population. In fact, 80 per cent of Canada’s online banking population has registered for the service, demonstrating that it has become a crucial component of Canadians’ financial routines.

Growth wasn’t limited to users, though. Last year, the total volume and value of Interac e-Transfer transactions both increased, representing continued year-over-year expansion. Total transaction volume grew by 54 per cent, while the value rose by 45 per cent. With Canadians using Interac e-Transfer more than one million times a day on average, these increases suggest that the service has become an entrenched part of Canadians’ lives.

While Interac e-Transfer continues to gain new users, providing an accessible user experience remains a top priority. Last year’s statistics underline that need, as 76 per cent of Interac e-Transfer deposits took place on mobile devices. As consumers increasingly rely on smartphones to complete everyday financial transactions, the importance of secure and convenient mobile experiences becomes more apparent. The launch of Request Money and Autodeposit features in 2018 also catered to improving user experience, by allowing users to get paid quickly, securely and directly to their bank account.

Whether they’re paying a friend back for dinner or sending money to their children, Canadians have fully embraced the benefits Interac e-Transfer. Familiar and intuitive in equal measure, the service remains the ideal way for consumers and businesses to move their money, anytime, anywhere.