Learn how fees work at Interac

Switch Fee

| Product | Current Fee | New Switch Fee (Effective April 1, 2024) |

|---|---|---|

| Interac® Debit ABM Withdrawals | $0.016614 | $0.011480 |

| Interac Debit (including Interac contactless payments and ecommerce payments) | $0.012852 | $0.011380 |

| Product | Switch Fee |

|---|---|

| Interac® Debit ABM Withdrawals | $0.011490 |

| Interac Debit (including Interac contactless payments and ecommerce payments) | $0.011380 |

Interac Debit with Apple Pay* and Google Pay**

| Acquirer service fee | All applicable transactions Includes Switch Fee | $0.025 |

Interchange Fee

| Product | Interchange Fee | Applicability |

|---|---|---|

| ABM Withdrawals | $0.75 flat-fee | Per completed cash withdrawal transaction paid by Issuer to Acquirer |

| Interac Debit | $0.00 | Not applicable |

| Contactless Payments | $0.02-$0.055 flat-fee (See pricing structure below) | Per completed purchase transaction, and based on qualifying tier of merchant from which transactions originate; paid by Acquirer to Issuer |

| Interac Debit with Apple Pay* and Google Pay** (eCommerce) | 60 basis points capped at a transaction value of $300 Above transaction value of $300 there is a flat fee of $1.80 | All eligible transactions |

Contactless Payment Interchange Structure

| Transaction Amount | Interchange Tiers | Flat-fee Per Transaction | Criteria for Merchant Qualification |

|---|---|---|---|

| Transaction from $0.01 to $100.00 | Tier 1 Low-ticket Merchants |

$0.020 | Merchants in the following qualifying segments:

|

| Tier 2 High-volume Merchants |

$0.025 | Merchants and merchant enterprises that meet the minimum annual transaction volume threshold of 20 million Interac Debit Contactless transactions, based on transaction volume in the previous calendar year. | |

| Tier 3 All other Merchants |

$0.035 | Merchants that do not otherwise qualify for Tier 1 and Tier 2. | |

| Transaction from $100.01 to $250.00 | Tier 4 All Merchants |

$0.055 | All Merchants |

Interac Debit for e-commerce with Apple Pay and Google Pay (effective as of December 1, 2023)

| Interchange Tier | Interchange Fee | Criteria for Qualifications |

|---|---|---|

| Tier 1 (Default) | Tier 1 (Default): 60 bps (0.6%) per transaction (capped $300 at $1.80) | Merchants with up to 500,000 transactions in the previous calendar year |

| Tier 2 | Tier 2: 57.5 bps (0.575%) per transaction (capped $300 at $1.725) | Merchants with 500,001 -1,000,000 transactions in the previous calendar year in the following MCCs: – Local and Suburban Commuter Passenger Transportation (MCC 4111) – Wholesale Clubs (MCC 5300) – Discount Stores (MCC 5310) – Grocery Stores and Supermarkets (MCC 5411) – Taxicabs and Limousines (MCC 4121) – Clothing and Accessories (MCC 5611,5137, 5621, 5631, 5641, 5651,5661, 5691) – Package Stores Beer, Wine, Liquor (MCC 5921) – Parking Lots and Garages (MCC 7523) |

| Tier 3 | Tier 3: 55 bps (0.55%) per transaction (capped $300 at $1.65) | Merchants with greater than 1,000,000 transactions in the previous calendar year in the following MCCs: – Local and Suburban Commuter Passenger Transportation (MCC 4111) – Wholesale Clubs (MCC 5300) – Discount Stores (MCC 5310) – Grocery Stores and Supermarkets (MCC 5411) – Taxicabs and Limousines (MCC 4121) – Clothing and Accessories (MCC 5611,5137, 5621, 5631, 5641, 5651,5661, 5691) – Package Stores Beer, Wine, Liquor (MCC 5921) – Parking Lots and Garages (MCC 7523) |

| Tier 4 | $0.35/per transaction | ‘Tax Payments’ MCC: 9311 |

Interac Debit for online payments Acquirer Service Fees

| Completed purchases < $35 | Tier 1 ($0.00 to $15.00) | $0.115 |

| Tier 2: ($15.01 to $35.00) | $0.265 | |

| Completed purchases > $35 | Standard | $0.465 |

| Utilities | $0.415 | |

| Education | $0.365 | |

| Government | $0.365 | |

| Charity | $0.365 | |

| Financial/remittances | $0.765 | |

| All other transactions | Including declined purchases, refunds and administrative transactions | $0.015 |

| International Processing Fee | Fee applied to the total CDN dollar value for all Interac Online purchases completed at online merchants that operate outside of Canada |

150 bps |

*Interac Corp. will review and establish Tier 2 volume thresholds on an annual basis.

*All fees are subject to applicable taxes.

Fees Explained

Interac Corp. is committed to being a low-cost, economical payments provider.

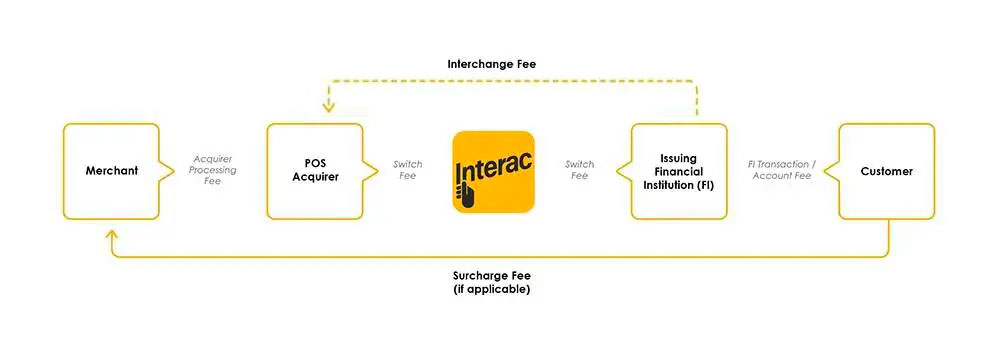

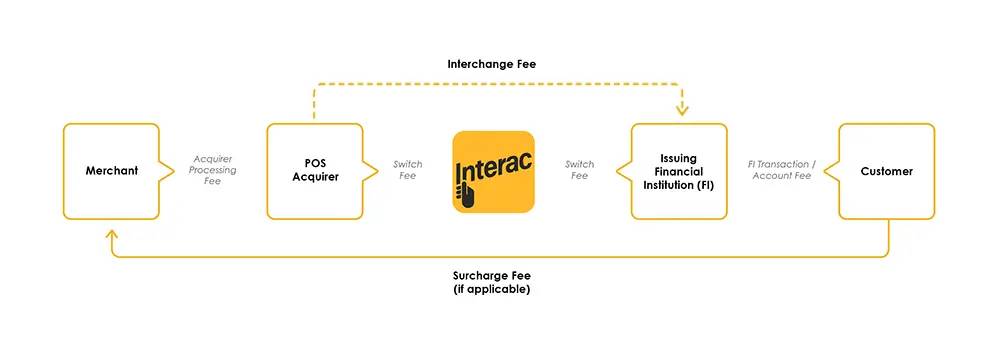

Interac Corp. participants include Issuing financial institutions (FIs) that issue payment cards and other devices that provide customers with access to their bank accounts and Acquirers that provide connection and other related services to merchants and ABM owners/operators. The fee charged to Issuing FIs and Acquirers by Interac Corp. are wholesale rates. Interac Corp. does not charge any fees directly to customers and merchants.

An Interac payment or money transfer involves multiple parties that connect directly or indirectly to the Interac network and each of these parties may pay fees and/or charge fees. Here is a brief summary of the fees related to Interac products.

ABM Withdrawals

Switch fee – ABM Acquirers and Issuing FIs that are participants of Interac Corp. pay a wholesale, flat-rate switch fee for every Interac Cash transaction message that they send to the Interac network. It is an annual, low-cost fee set on a cost recovery basis, and it is the only fee charged by Interac Corp. in connection with Interac Cash transactions.

Interchange fee – Interchange is a fee that a customer’s financial institution pays to the ABM Acquirer and it is intended to compensate the ABM Acquirer or ABM owner/operator for the service of providing cash to the Issuing FI’s customer. It is paid for every approved cash withdrawal transaction processed through the Interac network. While Interac Corp. has a role in setting the interchange fee rate, it does not receive any revenue from this fee.

Surcharge fee – ABM owners/operators may impose a surcharge (e.g., $2.00) on customers that use their ABMs. An ABM surcharge fee is also known as a convenience fee. As prescribed by the Interac Consent Order issued by the Competition Tribunal, Interac Corp. may not restrict the levying of a surcharge. If imposed, the surcharge amount must be properly disclosed to the customer, and the customer must be provided with the option of cancelling the transaction without cost if they do not wish to pay the surcharge. The amount of the surcharge is determined at the discretion of each ABM owner/operator.

Acquirer processing fee – ABM owners/operators pay a processing fee to the ABM Acquirer that provides them with connection services to the Interac network and the fee may include costs related to other services. The fee varies depending on individual contracts that ABM owners/operators have with their ABM Acquirers or connection service providers.

FI transaction/account fee – Customers may be charged a fee by their financial institution (FI) directly from their bank account for Interac Cash transactions (i.e., use of an ABM for a cash withdrawal that is not operated by their own FI). The application and amount of these fees vary and reflect the individual business decisions made by each individual FI. FIs may also charge a regular transaction account fee for Interac Cash transactions. These FI transaction/account fees may be included in a customer’s bank account package offered by their FI.

Interac Debit (including contactless payments)

Switch fee – POS Acquirers and Issuing FIs that are participants of Interac Corp. pay a wholesale, flat-rate switch fee for every Interac Debit transaction message that they send to the Interac network. It is an annual, low-cost fee set on a cost recovery basis, and it is the only fee charged by Interac Association in connection with Interac Debit transactions.

Interchange fee – Interchange is a fee that a POS Acquirer pays to the customer’s financial institution to balance the costs and benefits of offering the service to customers. Interchange for Interac Debit is currently set at zero. Beginning April 2016, a new interchange pricing structure will be introduced for Interac Flash. While Interac Corp has a role is setting the interchange fee rate, it will not receive any revenue from the fee.

Surcharge fee – Effective January, 26th 2024, the surcharge fee will only be allowed if debit services from more than one payment network are offered at the POS and it must not exceed the other payment network’s surcharge amount. If imposed, the surcharge fee must be capped at $0.25, must be printed on the transaction record, and must be applied by the merchant’s applicable Acquirer. The surcharge fee must be properly disclosed to the customer, and the customer must be provided with the option of cancelling the transaction without cost if they do not wish to pay the surcharge. Merchants may not directly apply a surcharge to any cardholder for the use of the Interac Debit Service.

Acquirer processing fee – Merchants pay a processing fee to the POS Acquirers that provide connection services to the Interac network, and the fee may include costs related to other services. The fee varies depending on individual contracts that merchants have with their POS Acquirers or connection service providers.

FI transaction/account fee – Customers may be charged a regular transaction account fee by their financial institution (FI) directly from their bank account for Interac Debit transactions. The application and amount of this fee varies and reflect the individual business decisions made by FIs. The fee may be included in a customer’s bank account package offered by their FI.

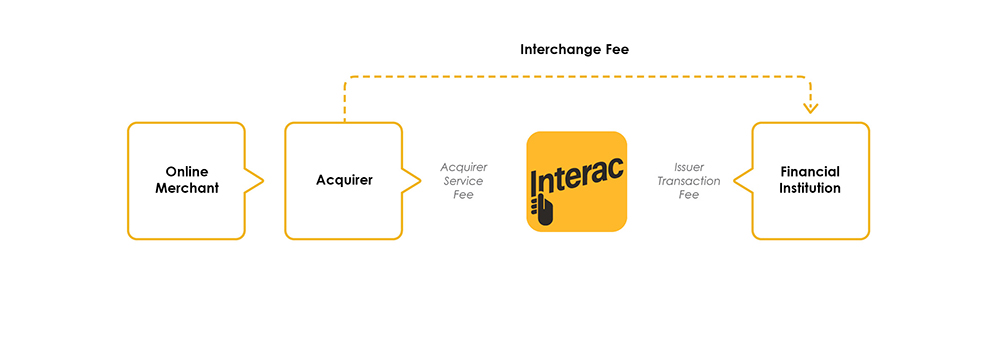

Interac Debit with Apple Pay or Google Pay

Issuer transaction fee – Participating issuers pay a wholesale, flat-rate transaction fee to Interac Corp. for eligible Interac Debit in-app and in-browser transactions.

Acquirer service fee – Participating acquirers pay a wholesale, flat-rate transaction fee to Interac Corp. for eligible Interac Debit with Apple Pay or Google Pay transactions.

Interchange fee – Interchange is a fee that an acquirer pays to issuers for each transaction that they initiate and that is subsequently approved by the issuer. Interac will calculate the interchange fee on a per transaction basis. While Interac Corp. has a role in setting the interchange fee rate, it will not receive any revenue from the fee.

Surcharge fee – Effective January, 26th 2024, the option to impose a surcharge on remote transactions using the Interac Mobile Debit (In-App/In-Browser) Service will not be permissible to align with market standards.

Interac e-Transfer

FI service fee – Financial institutions (FIs) pay a flat-fee to Interac Corp. that is based on tiered transaction volume for each Interac e-Transfer they send on behalf of their customers. The fee charged to FIs is a wholesale rate.

FI transaction/account fee – Financial institutions (FIs) may charge their customers a fee for sending an Interac e-Transfer. Depending on the banking package, these could be free at your financial institution.

The application and amount of these fees vary and reflect business decisions made by each individual FI. FIs may also charge their customers a regular transaction account fee for Interac e-Transfer transactions. These FI transaction/account fees may be included in a customer’s bank account package offered by their FI.

Interac Debit for Online Payments

Acquirer service fee – Acquirers pay a flat-fee to Interac Corp. for each completed transaction based on the customer’s purchase amount and merchant sector. The fee charged to Acquirers is a wholesale rate.

*For a list of compatible Apple Pay devices see support.apple.com/en-ca/. Apple, the Apple logo, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. Apple Pay and Touch ID are trademarks of Apple Inc.

*The Contactless Indicator is a trade-mark of EMV Co. LLC. Used under license.

**Google, Google Pay and the Google logo are trademarks of Google INC.

***All trademarks are the property of their respective owners.