Moving to a new country can inspire excitement, and also apprehension—especially when it comes to managing your finances. If you’re new to Canada, trying to navigate the financial system and balance budgets, ignorance isn’t bliss. And knowing what not to do can be just as important as knowing what to do.

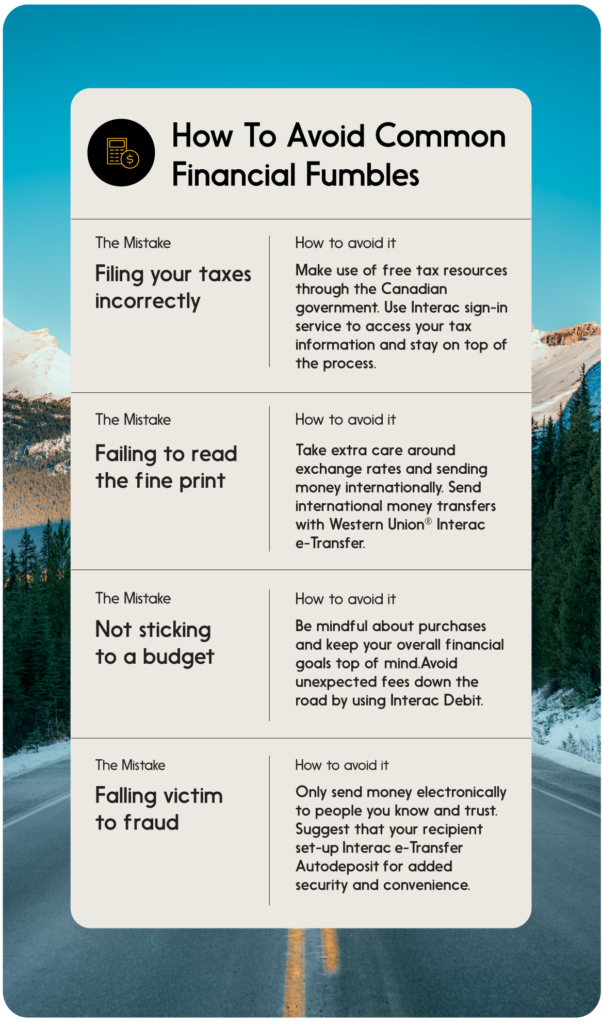

Here are some common money mistakes and misconceptions that could impact your financial future, and how to avoid them:

1. Filing your taxes incorrectly

Failing to pay your taxes—or to pay them properly—is a common mistake that comes with a high price tag.

If you’ve just moved to Canada, one of your first orders of business will be getting a social insurance number (SIN). When tax season rolls around, the Canadian government provides a wealth of resources on navigating the tax system, including a page specifically geared to newcomers. It’s a great place to start, with tips on:

Interac Verified can help simplify this process, from start to finish:

- You can use Interac sign-in service to access participating online government services. It’s a secure, private and convenient way to sign in without having to create and manage a new user ID and password by using your existing login credentials with a participating financial institution—after all, you have enough to keep track of already.

- If you’re registering with the Canada Revenue Agency (CRA) for the first time, you can use Interac document verification service to confirm your identity, providing you immediate access to your online account. Learn more about using Interac document verification service here.

2. Failing to read the fine print

It’s understandable if your eyes gloss over the terms and conditions section of a contract, or transaction, or service agreement. We’ve all been there. But when you’re getting up and running in an unfamiliar country, with an unfamiliar financial system, it’s extra important to read the fine print. Yes, all of it. Failing to do so could have long-term implications for your finances, credit score and more. The Canadian government provides resources regarding your rights and responsibilities when it comes to dealing with financial institutions.

Ensure you are careful when it comes to exchange rates and international money transfers. Avoiding hidden fees and getting the best rates when sending money back home often requires attention to detail. Two reliable options when it comes to sending international money transfers: International Transfer by Master and Interac, and Western Union via Interac e-Transfer, if offered by your financial institution.

3. Not creating a budget (or not sticking to it)

When you move to a new country, it’s easy to get caught up in the endless to-do list and let long-term (or even near-term) budgeting fall by the wayside. But this is one of those situations where it will benefit you tremendously to begin as you mean to go on.

So, take a deep breath, sit down, and set up a system of budgeting that works for you. Start by asking: What are your fixed costs? What are your financial goals? How are you keeping track of expenses? Do you have an emergency fund?

Plus: Asking yourself these questions is a great way to start cultivating financial mindfulness, but don’t be afraid to also embrace “loud budgeting”—vocally framing your choices and boundaries with friends and family. Interac Debit and Interac e-Transfer help you stay accountable to your own goals, because you’re only spending the money that is in your bank account, so you can always see how much money you actually have.

Once you’ve established a budget, the challenge, of course, is sticking to it. That means avoiding overspending on everyday items, being mindful about new purchases and keeping your overall financial goals top of mind. When you shop with Interac Debit or pay a vendor with Interac e-Transfer, you know exactly how much you’re spending, and you don’t have to worry about unexpected bills or fees down the road.

Credit Canada’s Butterfly app, sponsored by Interac, is another helpful resource when it comes to budgeting basics. It offers multilingual, tailored solutions and practice tools designed specifically for newcomers, from real-time currency conversion to tips for protecting yourself against fraud.

4. Falling victim to financial fraud

Speaking of fraud, unfortunately, online payment and money transfer scams often target people new to a country, including Canada. To protect yourself, only transact with people you trust. Using Interac e-Transfer Autodeposit provides added security (and convenience) for both parties—and it’s simple to set up.

And if you’re a business owner, Interac e-Transfer for Business can help you manage business transactions safely and efficiently.

And it pays to be alert to potential fraud attempts:

- Online marketplace scams: where a fraudulent seller asks for payment in advance and then never sends the item. Always read seller reviews and ask to meet in person (in a public setting) before sending money.

- Rental scams: where someone poses as an unavailable or proxy landlord and asks for a deposit, often through a money transfer. There isn’t actually a rental, and the deposit is gone. Avoid “landlords” who don’t want to meet in person and never send money for a security deposit without confirming the legitimacy of the property.

- Other common scams, from “phishing” and “whaling,” to bank scams, to email fraud.

By avoiding these common money mistakes, new Canadians can learn to navigate the financial system successfully, while settling into a new (and hopefully prosperous) life.

Want to learn how to spot scams that target newcomers to Canada?