It’s sometimes said that the holidays aren’t just a season, but a state of mind—one that shoppers are increasingly embracing through a mindful approach to their holiday spending.

The final Friday before Christmas—December 20—is expected to be this year’s busiest shopping day, according to new data from Interac, with the majority of Interac Debit purchase transactions expected to take place at restaurants and grocery stores. This suggests an increased focus on shared experiences with family and friends, as opposed to material gifts.

And while the predicted 25.9 million debit purchase transactions is surely a big number, it actually represents a slight dip in debit spending volume compared to last year’s Interac forecast (27.8 million transactions). This could perhaps be another indication that consumers are not only tightening their belts amid ongoing inflation concerns, but looking for last-minute deals to stretch their holiday budgets and embracing the broader trend of shopping with more mindfulness and intention.

2024 holiday shopping trends

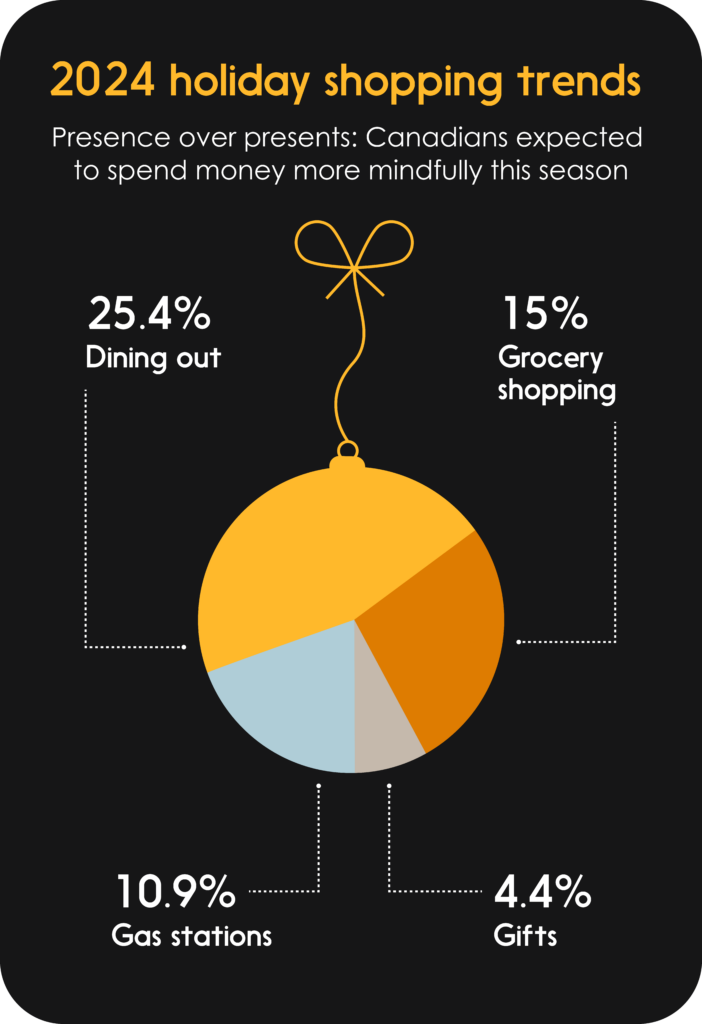

This 2024 holiday season, Canadians appear to be putting practical purchases at the top of their lists. According to the data, spending on the year’s peak shopping day is expected to break down as follows:

- Eating out: A quarter of the transactions (an estimated 25.4 per cent) are expected to be at fast food restaurants and eateries, as people gather to celebrate with friends and family or fuel up for all those holiday errands.

- Staying in: Along the same lines, grocery stores and supermarkets are expected to come in second at approximately 15 per cent, as Canadians stock up on all the ingredients and essentials required for hosting for festive feasts.

- Filling up the sleigh (or minivan): Gas station purchases are anticipated to account for another 10.9 per cent of transactions.

- Gifting: All that essential spending leaves approximately 4.4 per cent of transactions expected to go towards gifts and holiday deals at clothing and department stores.

The trend toward conscious consumption aligns with a recent Interac survey showing that Gen Z—a key consumer demographic—is prioritizing both mindful spending (62 per cent of respondents) and the option to pay with debit for both in-store and online purchases (57 per cent).

Conscious holiday shopping tips

Whether you’re spending on experiences, everyday essentials or special gifts, having a plan and taking a mindful approach can help you to navigate the holiday season and stay on budget.

- Gather ‘round the holiday table

- According to Interac data, many people are expected to be dining out at a restaurant this holiday season or ordering meals to-go. That makes sense, since some of the biggest holiday stressors involve the challenge of hosting guests and preparing a complicated meal for a crowd.

- Dining out at a restaurant makes it especially easy to overindulge—and hence overspend. That’s why it helps to have a meal budget in mind before the menus arrive. When you use Interac Debit, you’ll be paying with money directly from your bank account. And, when you’re at a holiday dinner out and need to split the bill, you can collect everyone’s share directly and securely with Interac e-Transfer. No cash, no cheques, no stress. If you need to follow-up to get reimbursed, you can use Interac e-Transfer Request Money.

- If you prefer to be home for the holiday meal, and it’s an option for you financially, having a restaurant cater your meal can reduce the stress of prep and clean up. For holiday takeout meals, using Interac Debit at pickup or within a food delivery app is a great way to stay in control of your spending.

- Making a list, checking it twice

- Holiday shopping lists aren’t just for keeping track of the naughty and the nice. Planning ahead can prevent you from succumbing to impulse buys, making it easier to stick to a budget when buying gifts and decorations. When you shop for the people on your gift list, think about your target budget going in and keep track as you shop.

- Making Interac Debit your default payment method is a great first step to streamline your holiday spending. Shopping with your own funds using Interac Debit helps you track spending in real-time and avoid surprise bills in January and post-holiday debt. And if you’re shopping in person, you can use contactless payments at participating retailers to reduce time and stress at checkout.

- With your finances in control, you’ll have more time to relax, kick back and enjoy the holidays.

- The more the merrier

- Some of us truly enjoy hitting those busy sidewalks (or e-commerce sites) for holiday shopping, while for others, nothing could be worse. That’s one reason it might make sense to gather a group to divide and conquer the gift list.

- If you team up with other people and come up with an idea for one big group gift, you can split the cost…and the work. For example, if you have a few siblings, you could pool your buying power on a joint gift for your parents. You can use Interac e-Transfer to easily share expenses with friends and family, and when you activate Interac e-Transfer Autodeposit, the money automatically lands in your account.

- If you want to contribute to a group holiday gift someone else is organizing, say for a classroom teacher, you can securely send your own money with Interac e-Transfer, too. And if you’re waiting for anyone to settle up, use Interac e-Transfer Request Money to nudge them.

- Group gift exchanges are another great way to keep costs under control. Gather a group of friends or coworkers, set a price limit and draw names. And if you feel inspired, it can be fun to choose an entertaining theme or try a “white elephant” gift exchange game, where each person brings a quirky or amusing item and participants can trade gifts along the way.

- Traveling home (or away) for the holidays

- When thinking about your anticipated costs, don’t forget to factor in gas for holiday travel and errands, and consider carpooling or using public transportation when possible.

- With many people off from work and school, the holiday season is a popular time of year for vacation travel, as well. If your plans involve driving and you decide to rent a car, consider settling your balance upon returning your rental using Interac Debit. Along the way, you can pay for gas, snacks and parking using Interac Debit or your mobile wallet.

- For ridesharing service, you can make Interac Debit payments through your digital wallet or split the costs afterward using Interac e-Transfer.

- Many transit systems across Canada accept Interac Debit as a contactless method for paying your adult fare. That means you can pay using your debit card, mobile phone, or wearable device, without having to carry a dedicated fare card issued by the transit authority.

Think outside the (gift) box:

At the end of the day, as ever, it’s the thought that counts. This holiday season, as shoppers in Canada focus on practical and flexible purchases, it reminds us that experiences and quality time with loved ones can be the most valuable gifts of all.

Cheers to a holly, jolly… mindful holiday.

Learn how Interac can help you manage your spending and make the most of your holiday moments