The Digital Authentication and Verification Timeline

A look over the years.

SCROLL TO START

Canada has entered a new age of digital connectivity, making everyday tasks such as banking, shopping, and accessing government services not only quick and convenient but in many ways more accessible.

As Canadians transact in a world that gives them more choice over digital solutions than ever before, the need for added security has grown, too.

With methods that include fingerprint scans, facial recognition, and validating your personal credentials and information, “digital verification” may sound new. While the concept of verifying one’s identity through digital channels is older than the internet itself, the methods have evolved. At Interac, we believe organizations that require verification of customer and client data should provide customers with secure, easy-to-use tools to verify their identity digitally. We launched Interac Verified, a suite of verification and authentication solutions, to enable them to do so — and in the bigger picture, to help accelerate Canada’s growth in a digital future.

To better understand digital verification, let’s explore a few moments from its (surprisingly long) history.

1960s

Invention of the password

To help ensure computer access is reserved for the right people and no one else, Fernando Corbató invents the computer password at MIT. This is considered the first use of digital verification.

1970s

Biotech hits the shelves

Biometric authentication technology, which includes hand, fingerprint, face and iris scanners, is developed and made commercially available. While initially a somewhat clunky method with large scanners, this technology eventually evolves to be a common method used to unlock digital devices.

1990s

Multi-factor authentication to securely access money in Canada

The debit card arrives in Canada, with all Canadian banks offering them by 1994. Debit cards are an early widespread use of multi-factor authentication, requiring the physical debit card along with a digital personal identification number (PIN) to access money through a bank account.

2000s

Invention of CAPTCHA

Robots everywhere are dismayed as the Completely Automated Public Turing test to tell Computers and Humans Apart (commonly known as CAPTCHA) is invented at Carnegie Mellon University, making the method of retyping a random set of keys or choosing specific images the first line of defense for many web sites.

2000s

Continued multi-factor authentication use

Multi-factor authentication, such as inputting a code for a new trusted device or confirming sign-in via email, sees wider use through varied login methods, trusted devices, and more.

2003

Authentication and transaction encryption to send and receive money

Interac e-Transfer launches, allowing individuals with a participating Canadian bank account to electronically send or receive payments within the country. The service employs encryption technology and a security question and answer to protect transactions, while users are digitally authenticated through their email addresses and/or phone numbers.

2010

Social sign-in takes off

Meta (Facebook) launches Facebook Connect, an early version of social sign-in that users still use today. With this solution, users could log in to participating apps and sites using their Facebook account.

2012

Financial institution credentials to access government services

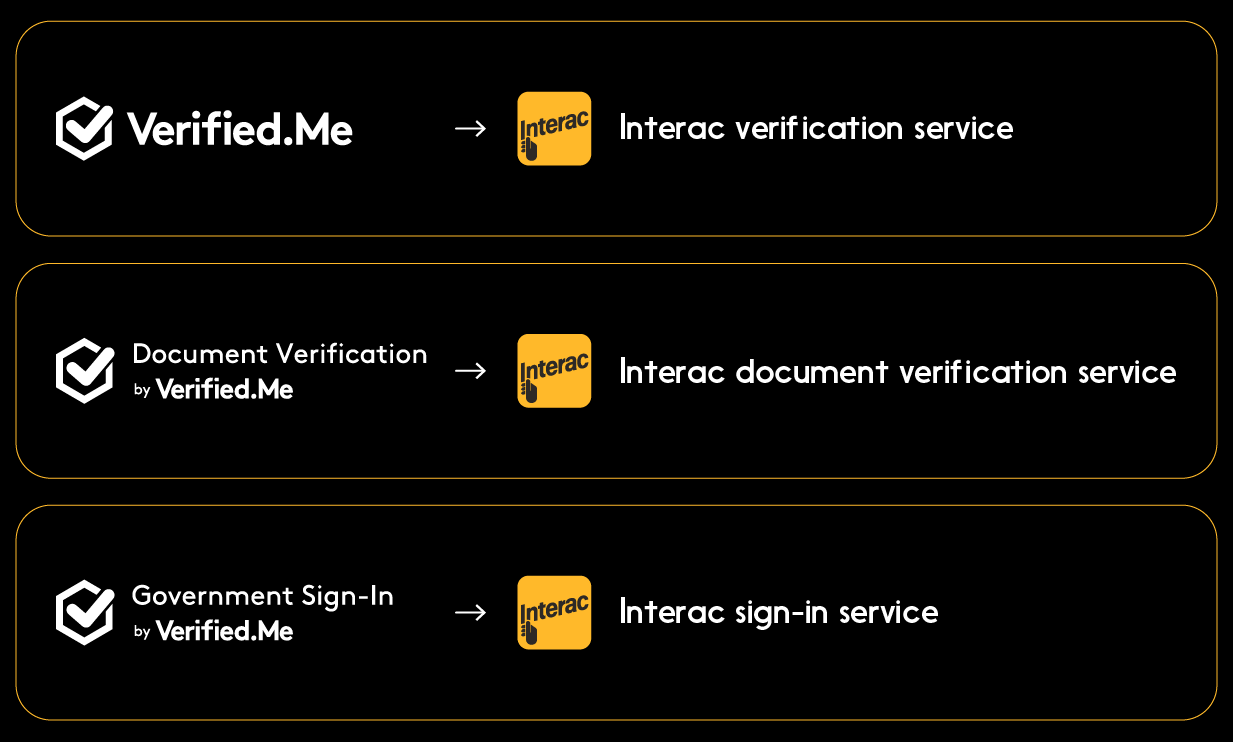

The launch of Interac sign-in service (formerly known as Government Sign-In by Verified.Me, and prior to that SecureKey Concierge and Briidge.net) enables Canadians to use trusted credentials from their participating financial institutions to securely access select government services.

2016

Tokenization to secure mobile transactions

Among the first in the world for a domestic debit network, the Interac Token Service Provider (TSP) enables secure mobile debit payments in Canada by substituting a consumer’s financial information with a randomly generated sequence of numbers (a token), which is meaningless to unauthorized parties.

2019

Identity verification through Canada’s financial institutions

Canada’s early adopter financial institutions begin onboarding Verified.Me (now called Interac verification service) and Document Verification by Verified.Me (now called Interac document verification service), providing a way for users to easily and securely verify their identities in order to access select services online or in person. Also in 2019, Interac announces the acquisition of Ottawa-based 2Keys, a national leader in enabling secure digital experiences for Canadian governments, financial institutions and commercial clients.

2021

Interac acquires SecureKey digital identity services

Interac continues to make investments to bring together digital identification (ID) and authentication capabilities to meet the evolving needs of Canadians and Canadian organizations by acquiring the exclusive rights to SecureKey Technologies Inc.’s digital identity services for Canada, including trademark licenses to the Verified.Me, Verifid.Me, Verify.Me, Briidge.net and One Tap marks.

2022

Integration of digital verification services

Having consolidated three verification services used by millions of Canadians into its suite of products, Interac announces changes to the services’ names: Verified.Me becomes Interac verification service, Document Verification by Verified.Me becomes Interac document verification service, and Interac sign-in service is the new name for Government Sign-In by Verified.Me.

2022

Interac sign-in service surpasses 100 million transactions

As Canadians seek secure and convenient ways to authenticate themselves online when interacting with participating government services online, Interac sign-in service surpasses 100 million transactions in 2022.

2023

Interac Verified debuts

Interac introduces Interac Verified, the new name for its verification and authentication business arm. This recognizes the incorporation of capabilities acquired by 2Keys and SecureKey and further developed into the Interac suite of services, and affirms the company’s foray beyond payments and its evolving role in helping Canadians transact digitally.

SCROLL TO CONTINUE