The future of identity verification is here. And it’s reusable credentials.

Today’s businesses need more than a one-time identity check. Verifying identity across multiple moments calls for a smarter, more secure way to build trust, reduce fraud, and streamline operations in an increasingly digital world.

Give your customers the ability to verify once and securely reuse their verified identity across services1. It’s security-first, designed for efficiency and backed by the same Canadian brand millions already trust for secure payments.

How can the Interac Verified credential service empower your business?

-

Reusable credentials.

With the Interac Verified credential service, customers can easily provide proof of identity when and where needed across participating organizations in Canada. No repeated steps or time-consuming checks.

-

Advanced data security.

Personal information is protected with Advanced Encryption Standard and is only accessible to authorized users.

-

Collect only what’s necessary.

Users share only the information that’s needed. This minimizes unnecessary data exchange, supports privacy, and helps your business reduce data storage.

Secure proof with widely used documents.

Customers can create secure credentials by logging into their online banking account with a participating financial institution1 and uploading eligible government-issued photo IDs and a video selfie. Supported documents include:

-

Passport

(Canadian issued and select foreign passports)

-

Canadian Driver’s License

-

Provincial ID Card

(Excluding Quebec)

-

Permanent Resident Card

-

Indian Status Card

100% Canadian

Leveraging decades of experience securing digital payments, the Interac Verified suite of solutions is now making access to online identity verification fast, easy, and secure for Canadians.

Ready. Set. Verified.

Log in and configure

Use our business portal to login and start the onboarding process. Configure your preferred verification method based on your use case and the user experience you want to offer.

Send a request

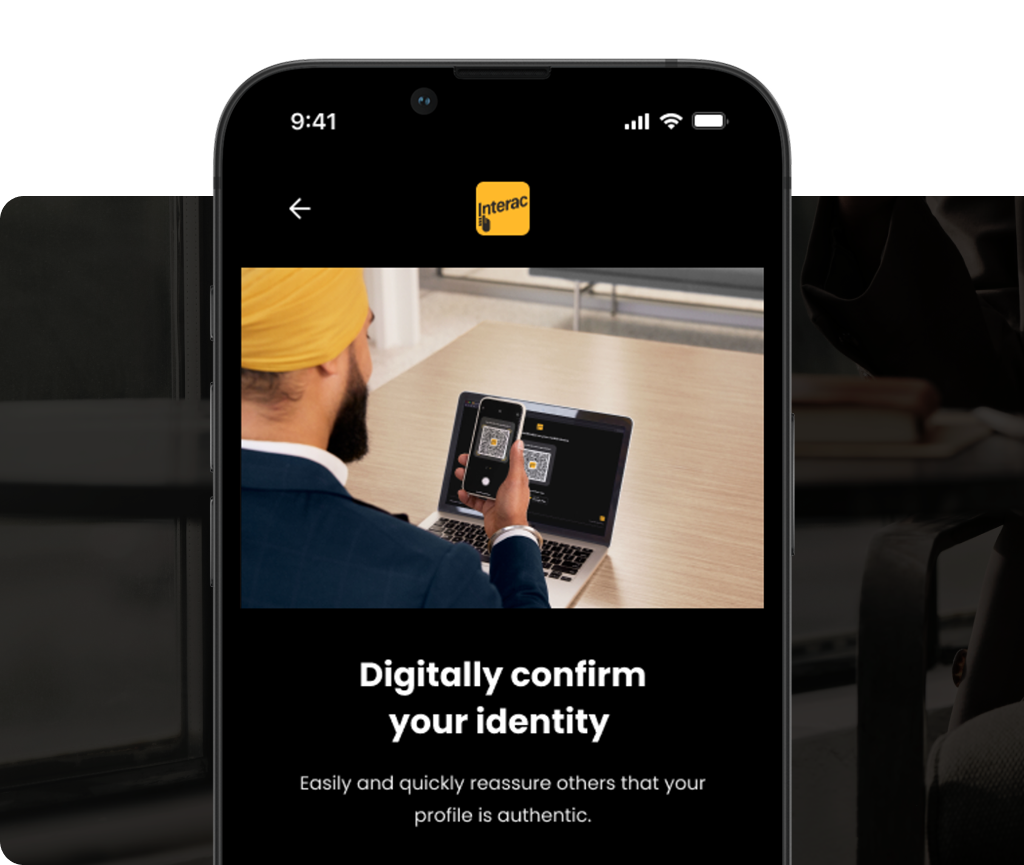

Invite users to obtain and share an Interac Verified reusable credential. They’ll verify their identity by logging into their online banking account at a participating financial institution1, then confirm their identity by uploading an accepted government-issued document photo and a live selfie.2

Receive and verify

The user receives your request to verify themselves by logging in to their existing online banking platform3. Once their credential is created, they can securely share the requested verified data with your business in just seconds.

Use Case Spotlight.

Smoother, safer real estate verifications.

In Canada’s fast-moving market, repeated identity checks and manual paperwork can slow everything down. The Interac Verified credential service aims to minimize the hassle of repetitive identity document sharing and can help reduce the risks tied to unsecured exchanges. For real estate agents in Canada, the service—delivered through the Interac Verified app, designed for convenience and mobility—can help simplify onboarding, giving them a more complete view of prospective clients and help them move forward with greater confidence on high-stakes deals.

For buyers and sellers, this can mean increased transaction confidence, leading to a more convenient, secure and straightforward experience. This is just the beginning of how Interac Verified can help transform real estate transactions to be not only safer but also simpler.

Ready to get started?

Get in touch with an Interac Verified expert who can discuss your needs and provide a walk-through of our verification solutions.

Connect with usTop frequently asked questions.

What is the Interac Verified credential service?

The Interac Verified™ credential service enables Canadians to create secure, reusable digital credentials that can be used to verify their identity with participating organizations. The service helps streamline verification, reduce fraud, and support data privacy by allowing users to share only the information that’s needed.

The service is currently available through the Interac Verified™ app, which allows Canadians who bank with a participating financial institution* and have an accepted government-issued ID** to verify their identity and securely store their digital credentials. With user consent and advanced encryption, the app helps businesses minimize the collection of sensitive information while simplifying onboarding and compliance needs.

How can Interac Verified credentials benefit my business?

An Interac Verified™ credential is an encrypted and signed record that verifies personal details such as name and date of birth. It is part of the Interac Verified credential service, which enables secure, reusable identity verification. For businesses, this means the ability to verify the identities efficiently and accurately. The credentials are reusable for up to a period of 12 months, reducing the need for repeated verifications and enhancing customer and transactional experiences.

The service is currently available through the Interac Verified™ app, where credentials are stored securely and can be shared with participating organizations. The app also facilitates selective information sharing. For example, verifying that a customer is over 19 years old without revealing their exact date of birth if that information is not required. Interac manages the process to ensure that only the necessary information is shared, tailoring each request to the specific verification needs.

How does the Interac Verified credential service enhance security for business transactions?

The Interac Verified credential service is designed to enhance security at every stage of the identity verification process. Personal information is encrypted, digitally signed, and shared only with user consent—reducing the risk of unauthorized access or data misuse.

When accessed via the Interac Verified™ app, credentials are securely stored on the user’s device and protected by smartphone-level security features such as biometric authentication. This decentralized, consent-based model minimizes the need for businesses to collect and store unnecessary sensitive information, helping to lower the risk of breaches and helping to meet compliance obligations.

By reducing reliance on manual processes and shifting control to the user, the Interac Verified credential service supports safer, more trusted digital interactions.What types of identification documents can be used to generate an Interac Verified credential?

The Interac Verified credential service accepts any of the below documents to issue an Interac Verified credential that can be shared with others. Currently accepted documents:

- Passports (Canadian issued and select foreign passports)

- Driver’s licenses (all 13 provinces and territories)

- Provincial Photo ID cards (all provinces and territories; excluding Quebec)

- Indian Status cards

- Permanent residency cards

1For a list of participating banks or credit unions that can be used to log in or access the Interac verification service or generate an Interac Verified credential, click here.

2For full list of government-issued documents eligible for verification to generate an Interac Verified credential, click here.

3If the user has not set up online banking with a participating financial institution, they will need to do so before proceeding.