Call it the summer of local love: In response to economic pressures and U.S. tariffs, Canadians have spent the sunny season shifting their dollars toward Canadian-made products and small shops and restaurants.

That’s according to a new survey from Interac, which also revealed that Canadians are choosing to redirect their dollars in ways that keeps the money local — 63 per cent have been making a conscious effort to shop local this summer, according to the survey of 1,500 adults.

Seventy-eight per cent of Canadians said supporting small businesses is more important to them now than a year ago, and that shift is showing up as rising support for independently owned restaurants and convenience stores, at the expense of big chains.

At the same time, consumers know their choices are making an impact. Lauren Mostowyk, Head, Integrated Marketing & Communications at Interac said, “We believe this intentional approach to spending reflects both economic necessity, and growing community and national consciousness.” Two out of three respondents (66 per cent) believe their spending habits impact their local communities. Seventy per cent believe they can make a direct impact on the Canadian economy through their spending.

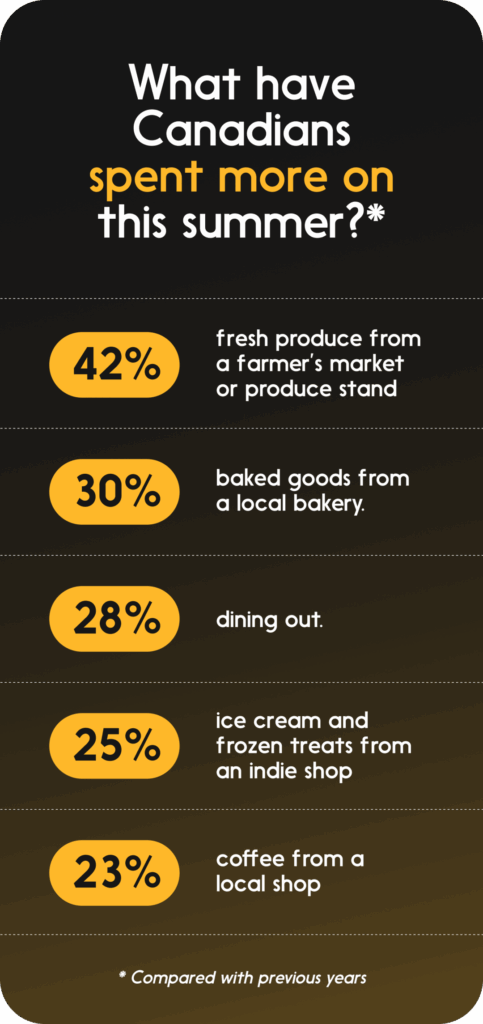

The wave of local support has touched all age groups and regions of the country. As millions of Canadians spend more at local businesses — notably on summer treats like ice cream and farmers’ market produce, according to the data, “Their small, everyday purchasing decisions are creating meaningful economic ripples across the country,” Lauren said.

Canadians support small businesses — at home and away

The Interac data confirms what Canadians have been saying in conversation with the media for months: When they’re shopping, they’re looking for the maple leaf. Whether it’s in the grocery aisle or at an online retailer, consumers are scrutinizing labels and making deliberate choices to keep their dollars on this side of the border.

Canadians’ commitment to supporting local has extended beyond their daily routines: It made a big impact on their travel choices this summer: Respondents showed a clear and growing preference for exploring within Canada — at the expense of short-term cross-border trips. And while exploring their own backyards, 63 per cent say it’s important to them to shop locally when they travel.

“This domestic movement channels spending directly into businesses right in our own backyard, strengthening communities from coast to coast. In fact, Interac transaction data shows higher frequency in tourism-related merchant categories compared to last year,” Lauren said.

‘Little treats’ soften the blow of financial pressures

This summer’s uncertain economic picture has been making Canadians more cautious with their spending this summer. Fifty-nine per cent said they’re avoiding unnecessary purchases, and 52 per cent are actively saving money.

Some people, however, are coping by indulging in little self-rewards — 43 per cent told Interac they’re willing to compromise on making large purchases, but they’re still treating themselves to small ones. Almost two-thirds (64 per cent) of survey respondents said small, affordable purchases help them feel better when times are financially tight.

Even while indulging in these small, affordable treats, Lauren noted, Canadians are showing their local love — by directing these dollars toward local businesses. “They’re transforming these little pick-me-ups into meaningful acts of community support,” she said. Accordingly, 60 per cent said treating themselves improves their day — especially when it involves supporting a local business.

How your tap supports small business and fuels the Canadian economy

Lauren said Canadians don’t just have a choice about where to spend their money; they also have choices about how they choose to pay. Different payment methods have different impacts on local businesses and the broader Canadian economy.

“By choosing Interac Debit, Canadians are using a 100 per cent Canadian payment method, ensuring more of their money stays in Canada. Plus, Interac Debit really benefits small businesses thanks to its lower transaction fees, which allow them to keep more of what they earn.”

More than 40 per cent of people surveyed were unaware that shopping with Interac Debit costs small businesses less in fees than some other methods.

As summer transitions to fall, “The growing awareness that everyday purchases can strengthen communities suggests this shift may have staying power,” Lauren said. “Canadians are discovering that even in challenging economic times their dollars can make a difference. It’s about making intentional choices about where and also how they spend.”

Get more advice on taking charge of your finances with Interac