If you’re feeling uneasy about holiday spending this year, you’re not alone: As we draw toward the close of a year characterized by tariff threats and an uncertain economic outlook, many Canadians have holiday overspending on their minds, according to a new Interac survey.

The holidays are known to be an emotionally fraught time of year, when hopes of magical times with friends and family can come crashing against harder realities — like budgeting or (worse yet) going over budget. Many Canadians say the pressure to make the holidays feel special drives overspending — from family expectations to social media ideals.

With its new survey, Interac wanted to gather and share data about the prevailing mood.

“With millions of transactions processed daily, Interac has a unique lens on Canadians’ spending habits. Our latest research shows the holidays remain a time when financial decisions weigh heavily on many households,” said Chris Lee, Head, Payments for Interac.

While the overall mood isn’t fearful, the survey showed most Canadians are taking proactive steps to avoid the financial regret that has become all too familiar in January. “What we’re seeing this year is that Canadians are what we could term ‘cautiously comfortable.’ Many are spending carefully and mindfully this season, partially in response to higher prices.”

For those who are watching their own spending this holiday season, here are six takeaways from the Interac holiday spending data.

1. Many Canadians are worried about overspending — something most of us have done before

Forty-two per cent of people surveyed said they’re worried about overspending this holiday season (that number rises to 52 per cent for parents, not surprisingly). And if they overspend and regret it, that will be a familiar feeling for many: Sixty-three per cent of Canadians say they’ve experienced regret or financial strain after overspending during the holidays, while 20 per cent admit it happens almost every year. And for a further 8 per cent, it’s practically tradition: They report overspending every year.

Lee said he would remind people that choosing Interac Debit when paying can help them keep their spending on track. “When you’re checking your spending in real time, paying with Interac Debit can help you stay aware and in control,” he said. “Because you’re spending money you actually have, there’s no surprise bill in January.”

2. More than half say rising costs are making it harder to control holiday spending

Even in a year when the inflation rate has eased back, most Canadians (57 per cent) agree that rising costs have made it harder to manage their holiday spending. Forty per cent believe their holiday budget from last year won’t be enough to cover everything this year.

Yet despite these pressures, most Canadians aren’t planning to go into debt trying to keep up. Fifty-nine per cent plan to spend about the same amount on gifts as they did last year, while 21 per cent are intentionally cutting back (versus 14 per cent who say they intend to spend more).

“You don’t have to overspend to have a meaningful holiday season, and most Canadians are choosing not to,” said Lee, who also notes that 37 per cent of people want to buy less and spend money more meaningfully. “For a lot of people, what truly matters is getting to spend quality time with the people they care about. As we’ve long pointed out, there are lots of great ways to spend quality time together responsibly.”

3. The busiest shopping day will be…

Friday, December 19, according to Interac data projections, based on millions of transactions from this and previous years. So if you’re heading out that day, expect it to be busy!

4. It’s normal to experience a mix of emotions over the holidays

The holidays bring up complicated feelings for many Canadians. When reflecting on their holiday shopping from last year, 21 per cent said they felt stressed, or overextended (13 per cent), remorseful (7 per cent), and even shocked by their spending (5 per cent). Others reported feeling confident (19 per cent) and proud (15 per cent).

In other words, no matter how you’re feeling, you’re in good company.

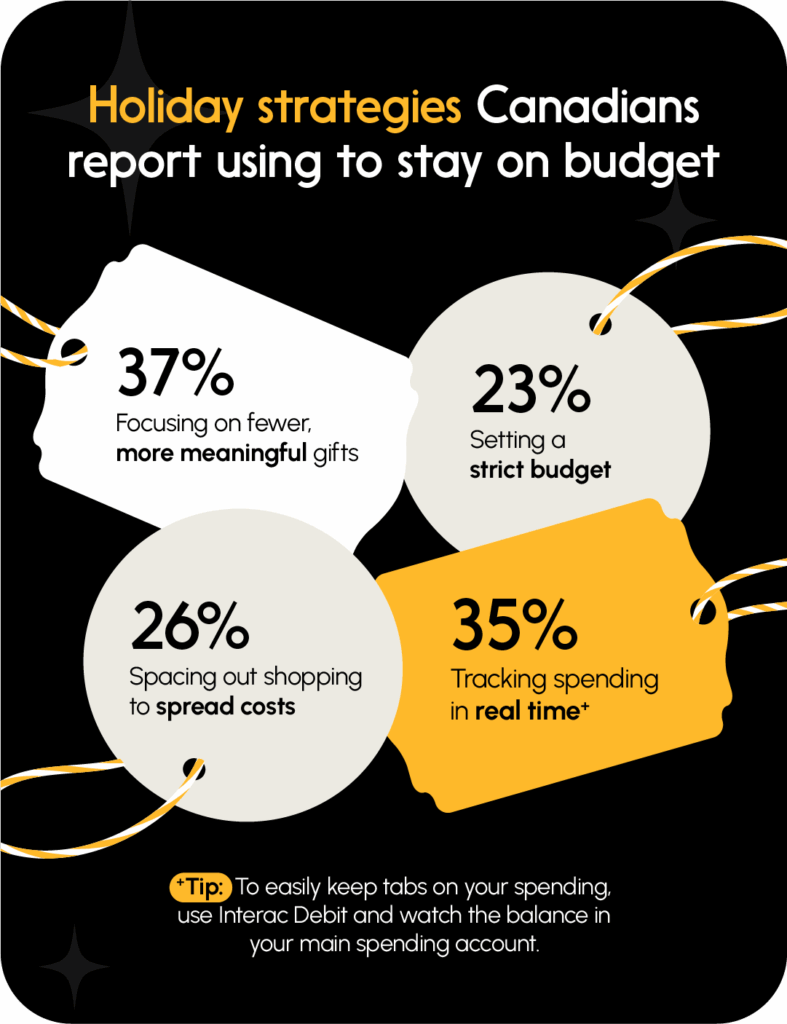

5. Canadians deploy a number of strategies to avoid overspender’s regret

Canadians are taking concrete steps to protect their financial well-being during the holidays. The most popular strategy is focusing on fewer, more meaningful gifts (37 per cent), followed by tracking spending in real time (35 per cent) and spacing out purchases to spread costs over time (26 per cent).

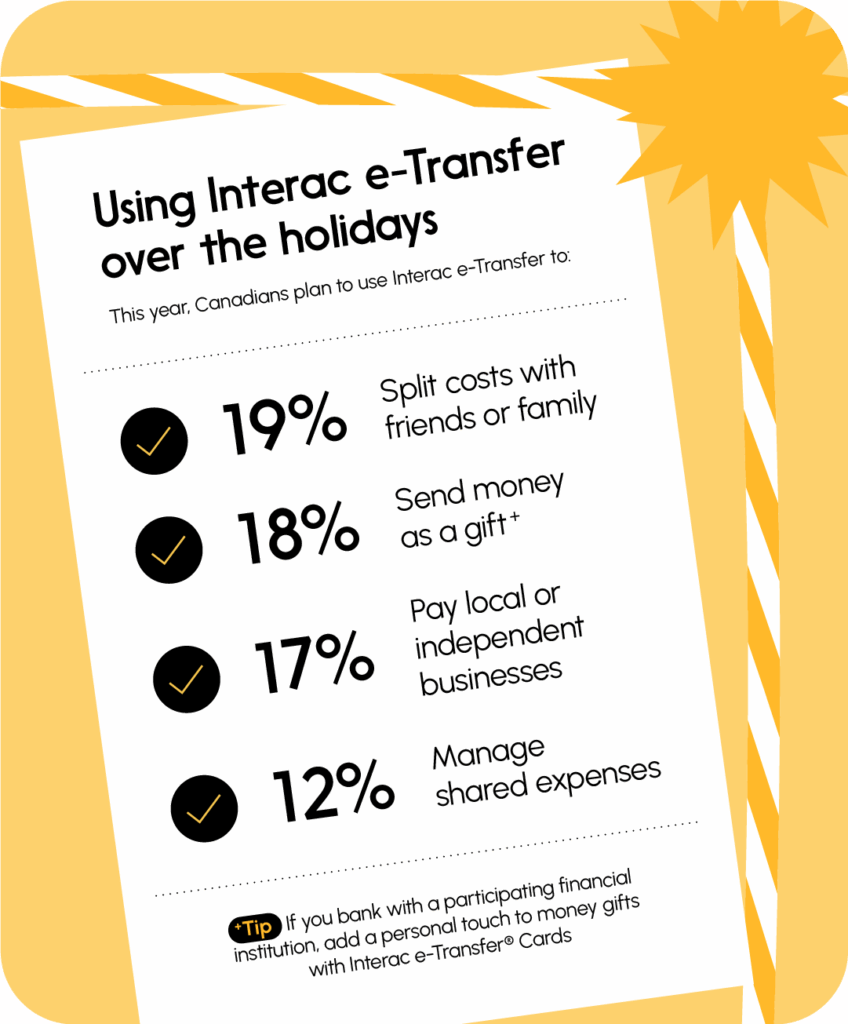

Twenty-three per cent are setting strict budgets and sticking to them, while 11 per cent are specifically choosing to pay with Interac Debit to ensure they only spend what they have. Ten per cent plan to split costs with family and friends — an approach that Interac e-Transfer can help facilitate, Lee noted.

“We believe the mindful spending strategies Canadians have adopted in the past few years are becoming established habits, especially as people start to feel the benefits,” Lee said. “Simple steps like paying with Interac Debit or using Interac e-Transfer to share hosting costs with family can make a real difference in how you feel come January.”

Meanwhile, 22 per cent admit they don’t have a holiday spending plan yet — but it’s not too late to start, Lee said.

6. Overall, Canadians seem comfortable but careful in their holiday spending outlook

Despite economic concerns in the news, most Canadians surveyed aren’t panicking — they’re adjusting. Nearly half (49 per cent) describe themselves as “comfortable, but watching their spending,” while 13 per cent say they’re financially secure and able to spend freely.

For those feeling anxious, small changes in behaviour can have big impacts, Lee added. Whether it’s tracking purchases as you go, choosing payment methods that keep you within budget, or using Interac e-Transfer to split costs with family — as 19 per cent plan to do — there are practical ways to enjoy the season without experiencing overspender’s regret.

“With the right approach and tools,” Lee said, “Canadians can fully enjoy the holiday season, taking memories with them and not regrets.”

Take control of your holiday spending with Interac Debit — make it your default way to pay in your phone’s wallet.

About the Interac survey

Interac commissioned Burson to survey 1,500 adult residents across Canada between November 19 and 24, 2025. The sample included 377 Canadian parents. The sample was randomly drawn from Leger’s web panel of potential respondents and weighted by age, gender and region to reflect Canada’s population distribution according to 2021 Census data. An associated margin of error for a randomly selected sample of n=1,500 would be ±2.5%, 19 times out of 20.