For many Canadians, the traditional two-week pay cycle doesn’t always align with the demands of daily life. An August 2024 survey found that 42 per cent of Canadian workers experience financial stress daily, and 66 per cent say it impacts their work performance.

The solution could be as simple as flexibility. Earned wage access (EWA) is a payroll benefit that allows employees to access wages they’ve already earned, whenever they need them. It’s not a loan or an advance from the employer; it’s the employee’s own money, made available on their schedule.

To make the real-time payments of EWA more readily available to Canadian employers and employees, the financial empowerment platform ZayZoon is working with Scotiabank to help expand access. But for any on-demand service to succeed, it needs a payment rail that’s secure and widely trusted, and that works in real time. This is where the proven and versatile technology of Interac e-Transfer for Business comes in.

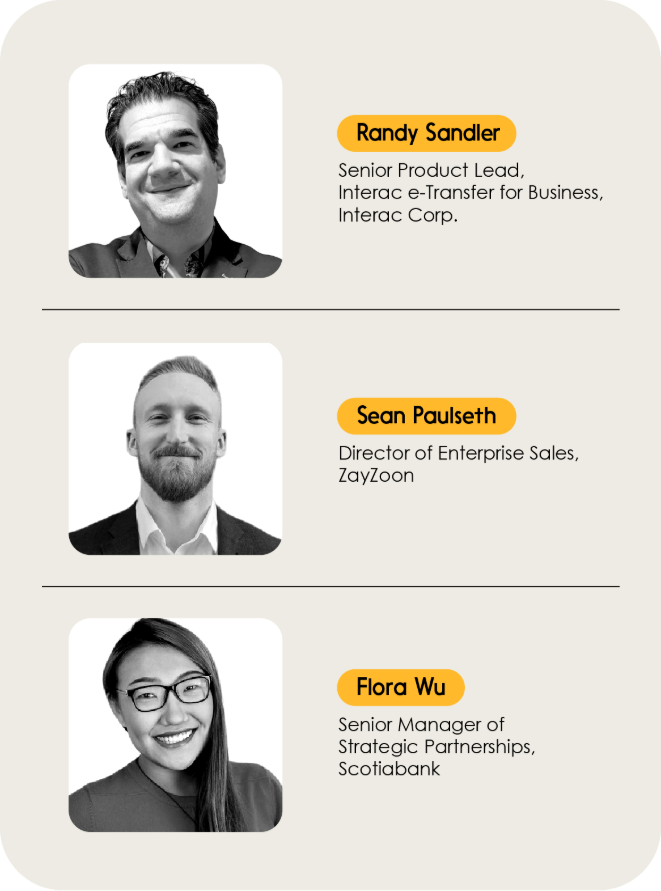

As the critical enabler behind the scenes, Interac e-Transfer makes real-time payouts a reality. To understand how this technology is transforming business payments and what it signals for the future, we spoke with Randy Sandler, Senior Product Lead of Interac e-Transfer for Business at Interac Corp., in conversation with Sean Paulseth, Director of Enterprise Sales at ZayZoon, and Flora Wu, Senior Manager of Strategic Partnerships at Scotiabank.

Q: We’re seeing a shift in how people think about their pay. From your perspective, what is driving the need for a solution like earned wage access?

Sean Paulseth, ZayZoon: The need is significant. Our research shows that 94 per cent of employees don’t feel comfortable asking their employer for a pay advance, so it’s a silent struggle. When people are living paycheque to paycheque, they’re going to find a way to get cash, and often that means turning to predatory options like payday loans. We’re trying to give them a better option that reduces financial stress and helps them avoid that cycle of debt.

Flora Wu, Scotiabank: We saw this need clearly from our clients. A lot of employers care about their employees’ financial well-being, but their hands are tied. Their own cash flows are tight, and they can’t take on the administrative work of managing advances. That’s why we decided to partner with ZayZoon — to support a solution that solves this for both the business and the employee.

Randy Sandler, Interac: For any business, cash flow is their lifeblood. This extends to their employees, who may be part of a younger or more transitional demographic and need financial confidence and consistency. EWA is a direct response to this. The role of the payment platform is to provide the speed and dependability that makes such a service viable. Employees need to know that whether they’re cashing out their wages or receiving a payment, the experience will be consistent and secure, regardless of who their employer or financial institution is.

Q: Can you walk us through the mechanics of how your organizations worked together? How have the three organizations — Scotiabank, ZayZoon and Interac — collaborated to deliver this service?

Randy Sandler: In the Canadian financial services context, Interac is a payment rail connected to essentially every financial institution. Our direct customer here is Scotiabank, which uses our Interac e-Transfer platform to provide services to their corporate clients. And when ZayZoon needs to send disbursements for EWA, they use our platform through Scotiabank. This allows them to send money to nearly anyone in the country using just an account number, an email, or a mobile number. [Interac and Scotiabank have] a long-standing relationship that allows for this kind of innovation to be built on a trusted foundation.

Flora Wu: For us, the first step was supporting the necessary payments workflow for ZayZoon to operate in Canada. Through our Scotia TranXact™ platform, we offered them the Interac e-Transfer “send” feature. It just came naturally as the solution to offer ZayZoon as a client and partner to send all of those requests to people’s bank accounts all over Canada.

Sean Paulseth: And that connection is what makes this possible on our end. The partnership helps us to connect payouts to 99 per cent of Canadian bank accounts. That coverage is really unique within the industry.

Q: The near-instant nature of the payouts seems central to the user experience. How does Interac e-Transfer support that speed and reliability?

Randy Sandler: Interac e-Transfer for Business is synonymous with real-time payments in Canada, and we’ve applied that same experience to the corporate payment scenario. ZayZoon can build a customer experience where their end users receive funds in a matter of seconds. We’ve made significant operational and infrastructure-level improvements behind the scenes to handle the load of high-volume, on-demand use cases like this.

Sean Paulseth: That speed is crucial. Leveraging the Scotia TranXact™ technology allows us to use the Interac rails to send the payouts. It’s quick, convenient, and something people are comfortable with. The funds can be in bank accounts in seconds.

Q: Beyond the payout, the ZayZoon platform includes a suite of financial wellness tools. How does a dependable payment rail like Interac e-Transfer support that broader value proposition for an employer?

Randy Sandler: There are three key elements that make our platform dependable. First is reach; our platform connects to nearly every Canadian. Second, it’s governed by the Bank of Canada and has world-class systems to make it available at all times. And third, it’s real-time. For a business offering a full suite of tools, this foundation is critical. It means they have a clear line of sight on the payment component, knowing exactly when money is delivered. This reliability allows them to build trust with their users and focus on enhancing their entire platform.

Flora Wu: And that reliability is what allows us to offer this to our clients with confidence. Employers want to help, but they have constraints. A solution like this, built on a dependable platform, removes the complexity and risk for them. It’s a win-win for both the employees and the employers.

Q: When you’re moving money at this scale and speed, security is a major consideration. What measures are in place to ensure these transactions are secure?

Randy Sandler: We play an important role setting governance, rules and standards for the entire network. This includes security and infrastructure requirements for processing payments. We have world-class fraud and scam detection capabilities, and we work closely with financial institutions to screen payments for fraudulent activity. All communication of payment messages, which includes personally identifiable data, meets high security standards like ISO 27001. We ensure the entire market operates within these standards, so businesses and their employees can have confidence in every transaction.

Q: Earned wage access is still a relatively new concept in Canada. How is ZayZoon helping to educate both employers and the general public about its use and benefits?

Sean Paulseth: The important thing for Canadian businesses to know is that EWA isn’t a new technology or benefit — it’s just newer to Canada. It’s been in the U.S. and Europe for about 10 years. So really, our primary job is education, showing how this is a responsible alternative and a tool. We’re getting a lot of great traction and we’re at the point where offering EWA is becoming a competitive differentiator. I think in a couple of years’ time, it will be status quo.

Flora Wu: We’re bringing it up as an innovative solution in conversations with our existing and prospective clients, because we understand that this is a newer concept in Canada and that people are still learning about it. We see it as our role as a trusted advisor to show our clients that there are new ways to support their employees’ financial well-being.

Q: As EWA becomes more common — with employers reporting benefits like a 29 per cent reduction in turnover — how is Interac positioned to handle the expected increase in volume?

Randy Sandler: Our Interac e-Transfer platform’s infrastructure is designed to handle high-volume, high-throughput use cases. For context, we are on track to process just shy of 1.6 billion transactions this year. Earned wage access is an important use case that helps the platform grow, but the system is fundamentally built to handle that sort of volume. As the EWA market scales, we’re confident that our platform can support that growth seamlessly.

This application of Interac e-Transfer for EWA is an example of adapting a familiar technology for a new business need. Looking forward, what other kinds of business opportunities do you see for instant, on-demand payments?

Randy Sandler: We see huge potential in any use case where there’s a need for instant gratification. Think of rebates, couponing or any sort of reimbursement. Instead of loyalty points, a business could send a $10 voucher directly to a customer’s bank account. We also see a lot of growth on the other side of the transaction: a person paying a business. Businesses want to lower their cost of payment processing, and Interac e-Transfer is a widespread, trusted and lower-cost alternative. Our aspiration is for Interac e-Transfer to be the leading payment solution for the entire small business market segment.

Learn more about how Interac, ZayZoon and Scotiabank are working to advance earned wage access across Canada.