Interac empowers seamless digital payment experiences with enhanced security for Canadians. Jeremy Wilmot, President and CEO of Interac Corp., explains our vision for the next era of the digital economy.

Read the letter2023 Corporate Year in Review

Accelerating Canada’s Digital Future

Interac Corp. empowers Canadians to transact with confidence by providing payment and value exchange services. Developing the future of money and verification in Canada means security and privacy are at the core of everything we do.

The 2023 Corporate Year in Review provides information about our annual performance, strategic plans and the important role Interac plays in the lives of Canadians.

While not a publicly traded company, transparency and accountability are central to our place in the Canadian economy. We are committed to delivering shared value across the ecosystem through the scale and reach of our networks and platform.

Message from the President and CEO

Message from the Chair of the Board

Interac is a cornerstone of the robust payment ecosystem Canadians know and trust. As we conclude 2023, Paul Vessey, Chair of the Board of Directors, reflects on a year of significant progress and growth.

Read the letterGood Corporate Governance

Our approach to corporate governance is based on the principle that good, transparent processes lead to proper outcomes. We enable that with clear direction and tone from the Board of Directors (Board) and accountability amongst our Executive team and staff.

Interac Governance Bodies

We hold ourselves accountable to a culture of transparency, integrity, and accountability at every level of the organization, from the Board of Directors to our Executive Team and our staff.

Board of Directors

Board members bring their industry insights, business experience, and individual perspectives while acting in the best interests of the company.

Read moreBoard committees

Seven Board Sub-Committees assist the Board in fulfilling responsibilities.

Read moreLeadership team

The Interac Executive Committee guides the Interac team in shaping the future of payments in Canada

Read more

A Culture of Good Ethics and Compliance

Good business ethics are essential to governance excellence. Interac has adopted a values-based and compliance program that uses resources efficiently and closely aligns with our corporate culture.

Interac’s Code of Business Conduct and Ethics summarizes the basic ethical and legal principles that guide the conduct of Interac Corp. and its employees. It fosters an open and transparent environment where employees can raise concerns without fear of retaliation, establishes the ability to address complex and sensitive issues and provides accountability if standards of conduct are not upheld.

Message from Mark O’Connell

Mark O’Connell stepped into the CEO role at Interac in 2007, tasked with taking an association, non-profit entity and leading it into a new era of access and service to Canadians. Over the 17 years that Mark was CEO of Interac he put an indelible stamp on the business and culture of Interac, and leaves a lasting legacy of Interac as a low-cost provider connecting Canadians, businesses and governments to their money and data. As he retires and passes the mantle to new President & CEO Jeremy Wilmot, Interac is helping more and more Canadian consumers and businesses navigate their increasingly digital day-to-day interactions.

Read moreMark O’ConnellIt has been an honour serving all of you as your CEO these past 17 years, and I am immensely proud of the work we have accomplished to build Canada’s most trusted brand. But it is time to pass the torch and I am excited to welcome Jeremy as our new President and CEO who will lead Interac to deliver on our vision today and into the future.

Corporate Performance

In 2023, Interac met or exceeded performance as measured by the Board of Directors.

Investment Highlights

Interac focused sharply on key priorities to accelerate growth of our commercial solutions. Highlights include:

Business payments

Enabled businesses to simplify payments and drive efficiencies with Interac e-Transfer for Business

Read more

Digital Payments

Surpassed one billion Interac Debit on mobile transactions in a 12-month period

Read more

Fraud Mitigation

24/7 fraud mitigation measures activated across the Interac ecosystem resulted in low fraud losses – less than 0.03 cents lost for every $100 spent.

Read more

People

We onboarded over 250 new employees to support our growth plans to accelerate the digital economy

Read more

Risk Management

The Interac Inter-Member Network (IMN) was designated as a Prominent Payment System (PPS) by the Bank of Canada.

Read More

Key Markers of Interac Growth

Interac demonstrated progress across revenue, fraud mitigation, network resiliency and product growth.

Revenue growth

Fraud losses

Network resiliency

Digital Transaction Growth

As digital transformation progressed for Canadians, so did the use of Interac payment and verification solutions.

1.16B+ total Interac e-Transfer transactions

6.5B+ total Interac Debit transactions

46.9% Interac Debit on mobile growth YoY

11M+ total transactions across Interac Debit e-Commerce payments through digital wallets

49.8% Interac Verification Service transaction growth in 2023

Interac e-Transfer for Business – Request Money 280% YoY Growth

Interac Strategy for Future Growth

We made significant strides in executing the three-year corporate strategy, demonstrating tangible progress in achieving our goals and setting the stage for sustained growth and innovation.

Our mandate remains steadfast: to deliver, manage, and advance interconnected networks and platforms that generate shared value across our ecosystem and stakeholders. We continue to leverage the scale and reach of our existing assets to drive innovation and enhance the overall value proposition.

Key priorities continue to revolve around strengthening our core business, expanding through ongoing initiatives, and exploring innovative adjacencies that contribute to value exchange. We remain committed to adapting to market dynamics and identifying strategic opportunities that align with our long-term vision.

As we move into the next phase of our strategic journey, our approach remains centered on delivering results. We are focused on executing the three-year integrated blueprint with an emphasis on three key pillars: people, delivery, and investment & return. To this end, we embarked on a corporate transformation to an agile structure, which included the redesign of our Executive Committee, followed by our senior leadership team to position the company to respond to an ever changing economic landscape and enabling Interac to scale faster, respond quicker to market demands and enhance customer service.

Broadening Government Relations

In 2023, Interac worked collaboratively with Canadian governments of all levels to build relationships and advance go-to-market priorities through sales enablement. We delivered public affairs and thought leadership to government and external stakeholders across a variety of channels.

Read MoreExpanding Access for Canadians

Canadian consumers and businesses confidently transacted in new ways with Interac

Helping Canadians Stay in Charge

Canadians need solutions to help knock down barriers and reinforce financial confidence during these uncertain economic times. Interac is investing in programming and resources that help to strengthen financial resilience in Canadians, especially among more vulnerable groups.

Read more

Unlocking Opportunities for Canadian Consumers and Businesses

Interac announced it was broadening access to the Interac e-Transfer service to an expanded category of financial institutions. Not only does this accelerate our impact in the market, it unlocks ways for Canadians to use and control their money and data. Wealthsimple is set to become the first new participant under this broadened access, joining 280 financial institutions on the Interac e-Transfer service.

Read more

Supporting Small Businesses

Small and micro businesses are a powerful force fuelling the Canadian economy. Interac offers services that allow small enterprises to solve business problems, unlock their full potential, and compete on the same playing field as their larger competitors.

Read moreBuilding Trust

Interac was recognized for our strong communities and our talented employees.

Strong Brand Reputation

In 2023, our brand was recognized nationally for helping Canadians stay in charge of their money, supporting small businesses and communities and being an employer of choice with a strong corporate culture.

Awards and Accolades

Generating Trust

We are witnessing a period of accelerated digitization in Canada. With this comes new opportunities and increased efficiencies. It also highlights one of the most important questions innovators face today: How can we give Canadians the confidence they need to participate fully in our emerging digital economy? Interac launched its Everyday Trust series to explore the role of trust in a rapidly changing technology landscape.

Read more

Protecting Privacy

Privacy was on our minds in 2023. Interac launched our first Data Privacy Week campaign to help Canadians understand the complex world of data privacy.

Read more

Authenticating Information Online

Consumers need to trust that they are getting secure and convenient digital access to services that require personal data verification. For businesses, trust is equally important: in order to confidently and securely provide a high quality, personalized product or service experience, businesses must be sure that customers are who they say they are. Interac conducted a survey of Canadian business decision makers to learn more about their awareness of digital verification solutions and adoption plans for the future.

Read more

Driving Innovation

How can the digital economy keep delivering more benefits for Canadians? With players across the ecosystem working together to make sure we build services they can trust.

Read moreWant to Know More?

Visit the stories below on Interac In the Know to learn more about how Interac is building trust with Canadians.

Interac Everyday Trust | Digital Verification in Healthcare

On Digital Health with Debbie Gamble and Zayna Khayat

Read moreDigital Competitiveness, e-Government & Digital Verification

On Digital Competitiveness with Debbie Gamble and Senator Colin Deacon

Read moreInterac recognized as the most trusted financial services brand in Canada for 2023

Interac Corp. today announced that it has maintained top spot as Canada’s most trusted financial services brand on the annual Gustavson Brand Trust Index for the ninth consecutive year.

Read moreCommitted to People and Community

In 2023 Interac made significant advancements in diversity and inclusion (D&I) and financial confidence in all Canadians.

2023 Highlights

Interac is committed to investing in our people and the communities where we live and work.

This is #InteracLife

Whether it’s building solutions that enable coast-to-coast transactions and secure interactions, taking advantage of learning and development opportunities, volunteering in local communities, or building connections at our hybrid corporate events, there’s no shortage of ways to be involved at Interac. Our employees share their elevator pitch on what #InteracLife means to them.

Read more

Investing in Communities

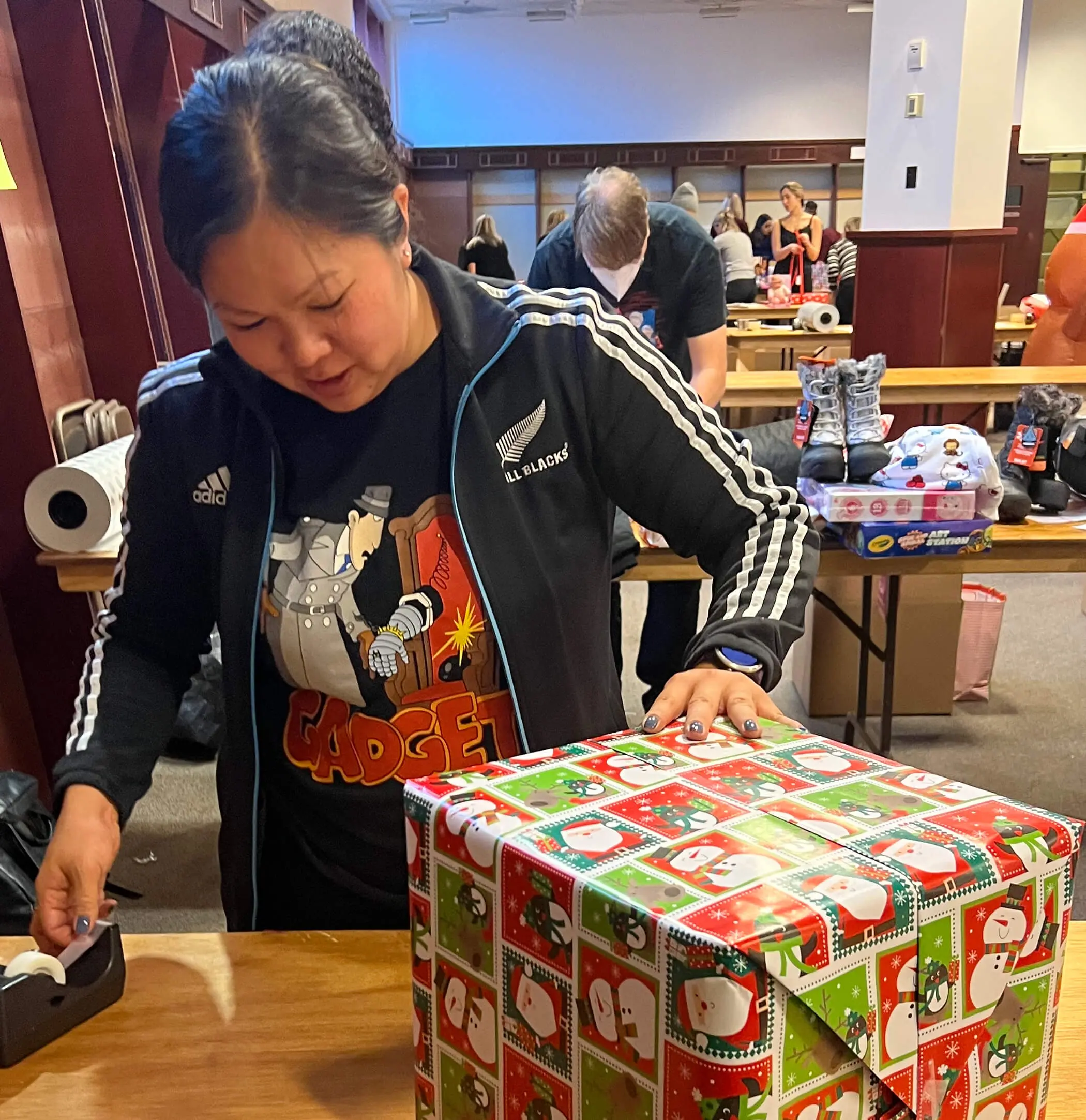

2023 was a significant year in advancing diversity and inclusion (D&I) at Interac and financial confidence in all Canadians. We continued our journey of fostering an inclusive culture within our walls and breaking down barriers for underrepresented Canadians to help them stay in control of their finances. This year brought many firsts, from new cultural celebrations to educational programming rooted in D&I for Interac employees. We invested a record number of funds in our communities, welcomed more than 200 new faces to our organization and helped more than 130,000 Canadians enhance their financial literacy skills through programming.

Read more

D&I Partner Spotlight

At Interac we’re not only committed to supporting D&I initiatives within our own walls, but also outwards in our communities. In 2023, we invested more than $ 1.3 million in community organizations. Meet Tanya Hayles, Founder of Black Moms Connection, a not-for-profit organization for more than 30,000 Black moms and families across Canada seeking to connect, share, and receive support. They offer financial support to Black moms in need, financial literacy programs and events, and wellness workshops and retreats. Learn more about Black Moms Connection, how they’re building financial confidence in moms across Canada, and how they leverage Interac e-Transfer to get funds into the hands of moms in need.

Read moreWant to Know More?

Visit the below stories on Interac In the Know to learn more about how Interac is investing in communities.

Building financial confidence through community outreach and education

An Interac commissioned financial confidence survey reveals insight into common issues threatening financial confidence of Canadians.

Read moreContributing to the future of FinTech at Elevate Festival

Interac is a proud founding sponsor of Elevate Festival.

Read moreNational Volunteer Week 2023: Making an impact in our community

For the second year in a row, Interac hosted National Volunteer Week from April 17 – 26. We focused our efforts to learn, address, and understand challenges affecting women and small businesses in our community through various volunteer initiatives.

Read more

Get to know us!